Wire transfers are a fundamental part of modern financial systems, providing a fast and secure way to send money from one bank account to another. They are an essential service for both individuals and businesses, facilitating transactions that range from paying bills to settling large-scale international trade deals. With the rise of digital banking, understanding how wire transfers work, their benefits and disadvantages, as well as their safety concerns, has become increasingly important.

In this guide, we will explore the different facets of wire transfers, including the mechanics of how they function, the differences between domestic and international transfers, and the fees associated with them. We will also take a closer look at the safety of using wire transfer services and weigh their pros and cons to help you make informed decisions the next time you need to send money electronically.

By the end of this article, you will have a comprehensive understanding of wire transfers, which will assist you in navigating financial transactions more effectively.

The Basics of Wire Transfers

A wire transfer is an electronic transfer of funds across a network administered by hundreds of banks around the world. Banks use a certain protocol for transmitting messages, allowing one financial institution to send payment instructions to another. The physical infrastructure used includes both a centralized database and external connections via telephone, internet, and other means to ensure efficient and secure transactions.

Wire transfers are often used for both domestic and international transactions. They can be processed within a few hours, making them a favored choice compared to other payment methods. However, it's essential to understand how wire transfers work and the potential issues that might arise.

- Ensure you have the correct banking details of the receiving bank or individual.

- Initiate the wire transfer through your own bank, providing the necessary information such as account numbers and amounts.

- Pay the associated fees, if any, and wait for confirmation that the transfer has been processed.

Understanding these basics will help you navigate the wire transfer process more effectively and protect your interests during transactions.

How Do Wire Transfers Work?

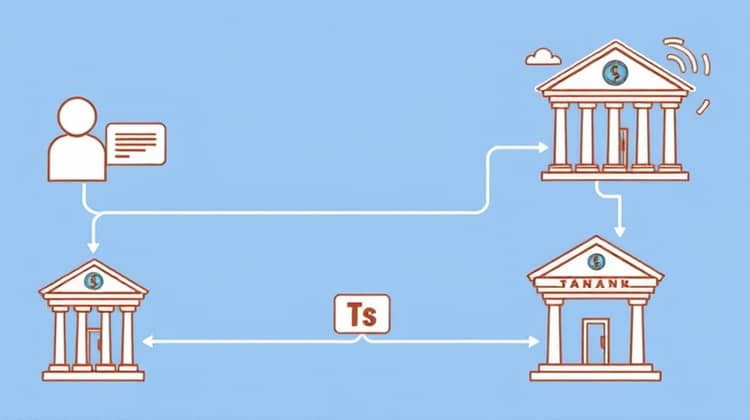

The mechanism behind wire transfers involves electronic communication between banks. When a sender initiates a wire transfer, their banking institution sends a message to the recipient's bank through secure methods outlining the necessary details—this includes the amount to be transferred, the sender’s and recipient’s banking information, routing numbers, and other necessary details.

Once the receiving bank acknowledges the transaction, it credits the recipient's account almost instantly. Although the transaction may be completed quickly, it could still take some time for the funds to become available to the recipient, depending on the bank's policies.

- The sender provides their bank with the recipient’s bank information.

- The sender’s bank verifies and processes the transfer request.

- Funds are sent electronically and arrive at the recipient’s bank, which verifies the transaction before crediting the recipient's account.

Understanding how wire transfers function is vital, as issues may arise during the process, leading to delays or even errors in fund transfer.

Domestic vs. International Wire Transfers

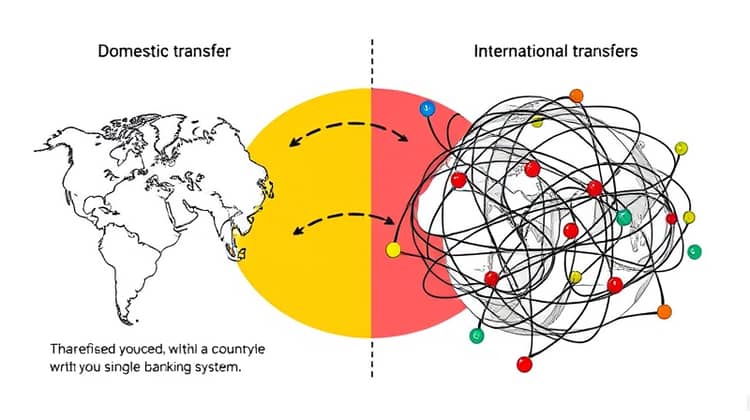

When considering wire transfers, it's important to distinguish between domestic and international transactions. Domestic wire transfers occur between banks located within the same country, usually making them faster and less complicated than international transfers. The infrastructure is more established, and the regulations governing these transactions are simpler because they fall under one jurisdiction.

On the other hand, international wire transfers involve sending money across borders, making the process more complex due to varying regulations and currency exchanges involved. Different countries have their own banking laws and standards, adding layers of scrutiny to such movements of funds. This can lead to longer processing times and additional fees that may not apply to domestic transfers.

Moreover, international wire transfers could involve risks such as fluctuations in exchange rates, which can affect the total amount received by the recipient.

- Domestic transfers are often completed within hours, sometimes even instantly.

- International transfers may take several days to process due to differing regulations and time zones.

- Fees associated with international transfers can be higher than those for domestic transactions.

Being aware of these differences can help you choose the right method for your financial transactions, ensuring that you plan accordingly.

The Pros and Cons of Wire Transfers

Wire transfers are a widely accepted method of sending money, but like any service, they come with their advantages and disadvantages. Understanding these can be crucial in determining when to use them and when to consider alternatives.

- Fast and secure form of money transfer.

- Suitable for large transactions.

- Direct bank-to-bank transfer reduces risk of fraud.

However, it’s important to weigh these benefits against the potential drawbacks of wire transfers to decide if they suit your needs.

The Pros

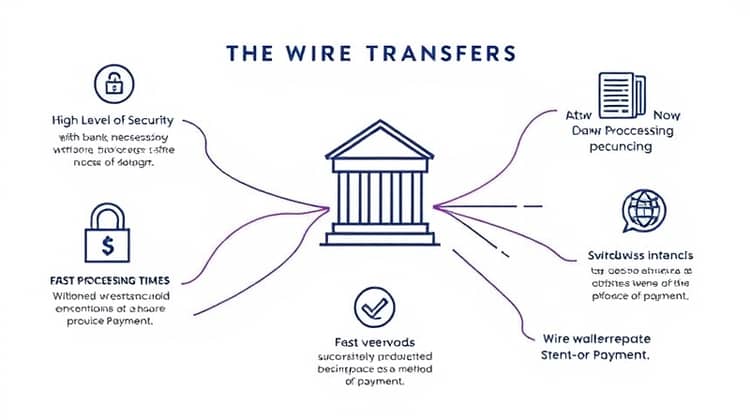

There are several advantages to using wire transfers for sending money, particularly when it comes to speed and security.

- High level of security with bank verification.

- Fast processing times, often same-day or next-day for domestic transfers.

- Widely recognized and accepted method of payment.

These pros often make wire transfers the preferred choice for personal and business use when necessary.

The Cons

Despite the many advantages, wire transfers do have their downsides. Understanding these cons can help you make better decisions regarding your financial transactions.

Additionally, both domestic and international transfers may incur various fees, which could be a drawback for some users.

- Fees can accumulate, especially for international transfers.

- Mistakes in banking details can lead to losses or delays.

- Not all banks offer wire transfer services, which can complicate transfers.

Being mindful of these cons is crucial, particularly if you're considering using wire transfers for significant amounts.

Are Wire Transfers Safe?

Wire transfers are generally considered to be safe and secure, especially when they’re conducted through reputable banks and financial institutions. The data provided during a wire transfer is encrypted, ensuring that personal and financial information remains protected during the transaction process. Additionally, banks utilize various security measures to monitor and prevent fraud during wire transfers.

However, users must also practice caution while initiating wire transfers. Scammers may try to exploit this process by impersonating legitimate entities to trick individuals into providing sensitive banking details. Therefore, verifying the identity of the recipient before initiating a wire transfer is crucial to safeguard your funds.

Moreover, unlike credit card transactions, wire transfers are usually irreversible. Once the funds are sent, there's no way to recover them without the recipient's permission, which is why it's essential to be 100% sure before hitting that 'send' button.

In conclusion, while wire transfers are indeed safe, exercising diligence and vigilance when sending money is imperative to avoid falling victim to scams.

Wire Transfer Fees

Like any financial service, wire transfers come with associated fees that can vary based on several factors.

- Domestic wire transfer fees typically range from $20 to $30.

- International wire transfer fees can be significantly higher, ranging from $40 to over $60.

- Banks may charge additional fees for exchange rate conversions for international transfers.

Being aware of these costs can help you plan your transfer more effectively and avoid surprises.

Conclusion

In summary, wire transfers are an essential service in today’s fast-paced world, providing a secure and efficient means of sending money. Understanding the mechanisms behind wire transfers as well as the various factors that influence their functionality—such as domestic and international distinctions—can significantly benefit the user.

While wire transfers are generally safe, users must remain vigilant against potential scams and always confirm the legitimacy of the recipient’s bank information prior to sending money. Additionally, the fees associated with withdrawals and international exchanges can impact the overall cost of the transaction.

Ultimately, by weighing the pros and cons and remaining informed, you can confidently utilize wire transfers efficiently and safely to meet your financial needs.