Understanding loan origination fees is essential for anyone considering borrowing money. These fees can significantly affect the total cost of obtaining a loan, so it’s vital to know where your money is going and how these fees impact your financial decisions. This article will provide a detailed overview of loan origination fees, including what they are, how they work, and strategies to negotiate or avoid them altogether.

In addition to defining loan origination fees, we will explore various types of loans that typically involve these charges and discuss the reasons lenders impose these fees. By the end of this article, you will have a comprehensive understanding of loan origination fees, helping you make informed choices when taking out a loan. This will empower you to seek out the best possible terms for your financial situation.

What is a Loan Origination Fee?

A loan origination fee is a charge by a lender for processing a loan application. It covers various administrative costs associated with the approval and closing of a loan, making it a common aspect of many lending agreements. The fee is typically expressed as a percentage of the total loan amount, which can vary depending on the lender and the type of loan being sought.

These fees are not the same as interest rates, which affect the total amount borrowed over time. Instead, they are upfront costs that must be paid, usually at the closing of the loan. Understanding these fees is crucial for prospective borrowers to accurately calculate the overall cost of their loan and avoid surprises during the borrowing process.

- Usually ranges from 0.5% to 1% of the loan amount

- Paid at closing and can sometimes be rolled into the loan

- Not refundable, even if the application is denied

Borrowers should carefully consider origination fees when comparing loan offers from different lenders, as these fees can add up quickly and impact the total cost of borrowing.

How Do Origination Fees Work?

Origination fees are charged to cover the processes involved in generating a new loan. These processes can include application review, credit checks, underwriting, and other administrative duties that lenders undertake to assess the borrower's profile and determine risk levels. When seeking a loan, borrowers should be aware that these fees are generally payable upfront at the time of closing.

Lenders may offer different fee structures based on the type of loan or the borrower's creditworthiness. A borrower with a stronger credit profile may be able to negotiate lower origination fees, while those with weaker credit may face higher costs. Therefore, it is beneficial for applicants to understand their credit situation ahead of time to gauge potential fees accurately.

- Fees are often part of the APR

- They can vary between lenders

- Some lenders may waive these fees for certain borrowers or loan types

Why Do Lenders Charge Origination Fees?

Lenders charge origination fees to recover the costs associated with processing and approving loans. The charge compensates the lender for their time and resources spent evaluating the applicant's creditworthiness and preparing the necessary paperwork. Thus, it’s an integral part of managing the financial services business.

Moreover, origination fees serve as a risk management tool. By charging upfront fees, lenders can offset potential losses associated with defaults and ensure that they maintain profitability in a competitive market.

- To cover administrative and processing costs

- To mitigate risk and add to profit margins

Ultimately, understanding why lenders impose these fees can help borrowers anticipate costs and make more educated choices when selecting a loan product.

Types of Loans with Origination Fees

Many loan types come with origination fees, affecting how much you'll need to pay either upfront or over time. Understanding which loans generally involve these fees can help you budget accordingly.

1. Mortgage Loans

Mortgage loans typically carry some of the highest origination fees compared to other types of loans. These fees usually range from 0.5% to 2% of the loan amount, impacting the overall cost of purchasing a home significantly. It's crucial for homebuyers to factor these costs into their budgets and compare offers from various lenders.

In addition to the origination fee, mortgage borrowers may face a variety of other costs, such as appraisal fees, title insurance, and inspection fees. Combining these costs creates a comprehensive view of what a home purchase will truly cost in the long run.

First-time homebuyers are often encouraged to shop around and ask for a breakdown of all fees associated with their mortgage. This diligence can sometimes lead to the negotiation of lower origination fees or better overall terms.

2. Personal Loans

Personal loans often include origination fees that may range from 1% to 8% of the total loan amount. These fees can significantly increase the total borrow amount, making it vital for borrowers to read the fine print and understand the total cost of the loan before committing.

Additionally, personal loans may come with varying terms and conditions depending on creditworthiness and lender policies. Some lenders may offer no origination fees as a promotional tactic or to attract good credit borrowers, while others may have fixed fees regardless of the loan amount.

Understanding the fee structure of personal loans helps borrowers make informed decisions and choose a product that best fits their financial situation.

3. Auto Loans

Auto loans may also feature origination fees, though these tend to be lower compared to mortgage and personal loans. Typically, the fee can range from a nominal charge to around 1% of the loan, depending on the lender.

Still, borrowers should be aware that these fees can differ by lender and even by loan terms. As a result, it's essential to compare different offers and ensure that the total cost of borrowing remains within their budget.

How to Negotiate or Avoid Origination Fees?

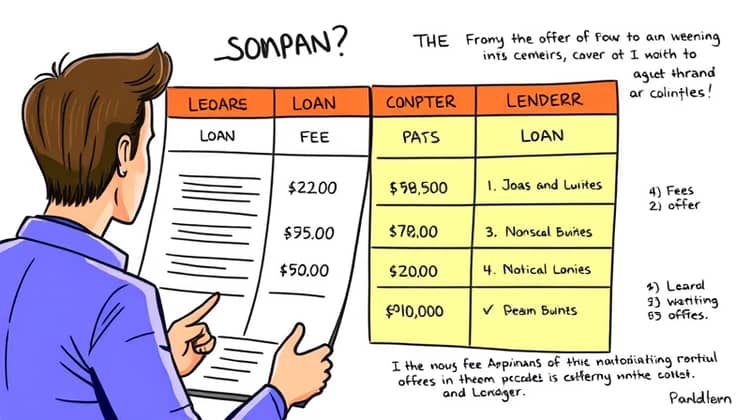

Negotiating or avoiding loan origination fees can lead to considerable savings. One effective strategy includes shopping around with multiple lenders and comparing the fee structures they offer. Borrowers can often use the offers received as leverage to negotiate better terms with lenders.

Additionally, some lenders may agree to waive origination fees for borrowers who exhibit strong credit profiles or who are bringing substantial assets to the table. In some cases, opting for lenders with no origination fees may be advantageous, but borrowers should ensure that they aren't compensating for these waived fees through higher interest rates or less favorable loan terms.

- Research multiple lenders to compare fees

- Leverage existing loan offers to negotiate

- Inquire about waivers for strong credit profiles

By employing these strategies, borrowers can effectively minimize or avoid origination fees, saving money in the long run.

Conclusion

Understanding loan origination fees is a significant step in the borrowing process. By familiarizing oneself with how these fees work and the various factors that influence their cost, borrowers can make informed financial decisions that align with their needs and money management goals.

Whether taking out a mortgage, personal loan, or auto loan, awareness of origination fees empowers borrowers to investigate and negotiate terms that can lead to financial savings.