In today's financial landscape, knowing the security of your money is paramount. The Federal Deposit Insurance Corporation (FDIC) plays a crucial role in safeguarding deposits held in banks and savings institutions. This article aims to elucidate the intricacies of FDIC insurance, providing you with the essential knowledge needed to ensure your funds are protected.

Understanding the coverage provided by the FDIC, the institutions it covers, and the limitations of this insurance can empower you to make informed decisions about where to keep your savings. By the end, you'll grasp how FDIC insurance operates and how you can verify your own coverage, ensuring peace of mind as you navigate your financial journey.

What Does FDIC Insurance Cover?

FDIC insurance is designed to protect depositors against the loss of their insured deposits in the event that an FDIC-insured bank or savings institution fails. When you deposit your money in one of these banks, your deposits are covered up to a certain limit. This insurance means that even if the bank goes bankrupt, you will not lose your money, making it an essential aspect of safe banking.

FDIC insurance typically covers standard checking accounts, savings accounts, money market deposit accounts, and certificates of deposit (CDs). However, it's important to note that not all financial products are protected.

- Checking accounts

- Savings accounts

- Money market accounts

- Certificates of Deposit (CDs)

While FDIC insurance significantly bolsters consumer confidence, it’s essential to understand the specific protections it offers to maximize your security.

How Does FDIC Insurance Work?

When a bank or savings institution fails, the FDIC steps in as the receiver and manages the liquidation process. If you have insured deposits, the FDIC will reimburse you up to the insurance limit—currently $250,000 per depositor, per insured bank, for each account ownership category—as soon as possible, typically within a few days of the bank's closure.

To qualify for coverage, your deposits must be held in a federally-insured institution. Therefore, it's critical to confirm whether your bank is FDIC member and understand the specific accounts that qualify for insurance.

- The FDIC pays depositors in cash up to the insurance limit.

- Depositors do not need to file claims as the FDIC automatically pays out insured funds.

- The coverage limit is per depositor, per bank, and per ownership category.

This payout system provides a safety net for account holders, ensuring that people can access their funds in the unfortunate event of a bank failure.

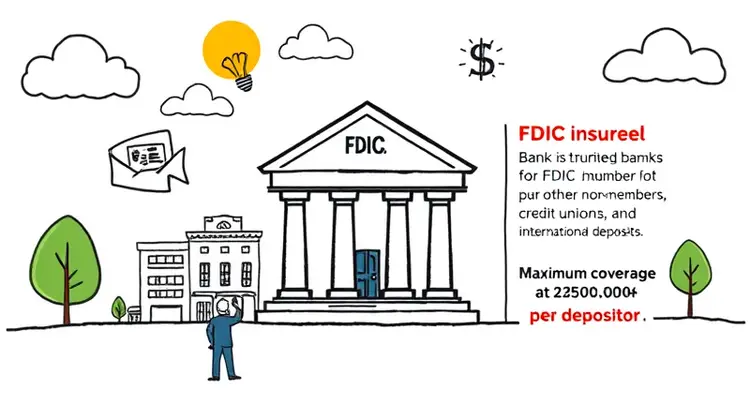

What Banks Are FDIC Insured?

In the U.S., most commercial banks are insured by the FDIC. This includes national banks, state-chartered banks, and savings institutions that operate under state regulations. Consumers can easily verify if their bank is FDIC-insured by checking the FDIC website or looking for the official FDIC logo on the institution's materials.

It’s important for consumers to remember that only deposits in banks and savings institutions are covered. Credit unions, for instance, are insured under a different scheme, namely the National Credit Union Administration (NCUA).

Due diligence is essential; consumers should verify the legitimacy of their institution, especially with the rise of online banks. While online banks can and do offer FDIC insurance, traditional due diligence remains critical in ensuring your financial safety.

You can also find a list of FDIC-insured banks by searching the FDIC Directory of Insured Banks, allowing you to check if your current or prospective bank falls under FDIC coverage.

How Much Coverage Do You Have?

The FDIC insures deposits in member banks up to $250,000 for each depositor, per insured bank. It is crucial to understand how account ownership affects coverage limits. For example, if you have a joint account and an individual account, the combined coverage can exceed $250,000, as each account holder is insured separately.

To ensure that your deposits are fully protected, consider spreading your money across multiple banks or accounts, especially if you are saving more than the insured limit. This strategic planning can safeguard your savings from the uncertainties of bank failures.

- Individual or single accounts are insured up to $250,000.

- Joint accounts have a limit of $250,000 per co-owner, effectively doubling coverage limits.

- IRAs and certain retirement accounts also have separate insurance limits.

Understanding these limits is vital when deciding how much money to keep in any one bank.

Beyond Basic Coverage

While FDIC insurance provides essential protections for deposit accounts, there are additional financial products and services offered by banks that may not be covered. For instance, investments like stocks, bonds, mutual funds, and life insurance policies are not insured by the FDIC. Consumers should remain aware of these limitations when managing their overall financial strategy.

Additionally, higher interest-earning accounts, such as certain types of certificates of deposit (CDs), may offer higher yields but also come with specific maturity terms and restrictions that could impact withdrawal options.

Limitations of FDIC Insurance

Although FDIC insurance offers vital protection, it does have its limitations. Primarily, the coverage only applies to deposits in FDIC-insured banks and savings institutions. Other financial products, including securities, mutual funds, and other investment vehicles, are not protected under this insurance scheme.

Moreover, the FDIC does not insure deposits in non-member banks or credit unions, nor does it cover international deposits. As a result, it's crucial for consumers to understand where their money is being held and the protections available.

- Not all financial products are covered.

- Coverage limits exist, with a maximum of $250,000 per depositor for each bank.

- Deposits at credit unions are insured by the NCUA, not the FDIC.

In essence, consumers should be proactive in understanding the nuances of their financial products to ensure their money is thoroughly protected.

How to Make Sure Your Money is FDIC Insured

To ensure your money is protected under FDIC insurance, start by choosing banks or savings institutions that display the FDIC logo, which indicates membership. Additionally, checking the FDIC's online database allows you to verify whether a bank is insured.

Moreover, it is wise to stay informed about your account types and ownership structures that affect insurance limits. Frequent review of your banking relationships also aids in confirming that your accounts remain within insured limits.

Conclusion

FDIC insurance serves as a crucial pillar of financial security for millions of Americans. Understanding what it covers, how it works, and the limitations involved can empower consumers to make informed decisions regarding their financial assets. Knowledge on how to verify FDIC insurance can additionally enhance peace of mind.

Ultimately, being proactive about your financial safety by ensuring your deposits are protected under FDIC insurance can lead to greater confidence in managing your monetary resources effectively.