Setting up direct deposit can simplify your financial management and enhance convenience. With direct deposit, your salary and other payments can be automatically transferred into your bank account, ensuring timely access to your funds. This quick guide will help you understand the process and benefits of setting up direct deposit.

1. What is Direct Deposit?

Direct deposit is a payment option that allows funds to be electronically transferred directly into your bank account, eliminating the need for physical checks. It is widely used by employers to pay employees, government agencies to disburse benefits, and various institutions for other payments.

When you opt for direct deposit, you provide your bank account details to the payer. Once the account is set up, each payment is automatically routed to your account on the payment date.

The primary benefit of direct deposit is the speed and efficiency it offers. Instead of waiting for a check to arrive, your funds are typically available on or before the payment date.

Overall, direct deposit provides a more secure way to receive funds since it reduces the risk of lost or stolen checks.

2. Why Choose Direct Deposit?

Choosing direct deposit streamlines your cash flow management and enhances your financial organization.

- Guaranteed on-time payments

- Reduced risk of check fraud

- Easier budgeting with consistent cash flow

- Convenient access to funds without physical banking

As you can see, the advantages of direct deposit make it an appealing choice for both individuals and organizations.

3. How to Set Up Direct Deposit

Setting up direct deposit is a straightforward process that can be completed in a few simple steps. Gather the necessary information and complete the required forms correctly to ensure a smooth setup.

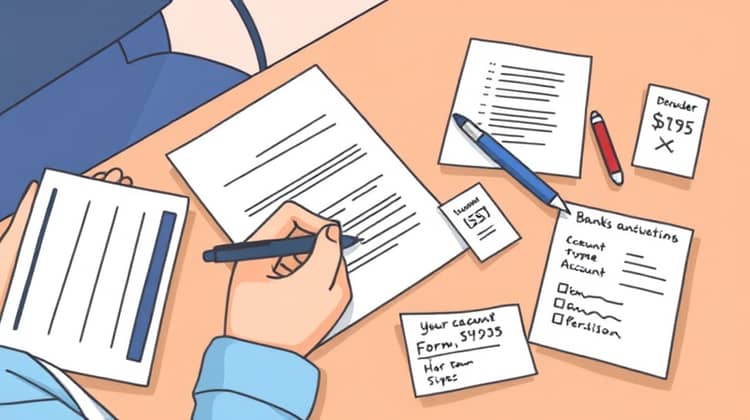

a. Gather Your Information

Before filling out the direct deposit form, make sure you have the following details ready. This information is crucial for successful setup.

- Your bank account number

- Your bank's routing number

- Account type (e.g., checking or savings)

- Personal identification information

Having this information on hand will help expedite the completion of the direct deposit process.

b. Complete the Direct Deposit Form

Once you have all the required information, you can proceed to fill out the direct deposit form. Typically, your employer or the organization handling the payments provides this form.

Completing the form correctly is imperative to avoid delays in your payment.

- Enter your personal information accurately

- Provide your bank account details

- Review the information for any errors

Take your time to ensure every detail is correct, as mistakes can lead to payment issues.

c. Submit the Form

After completing the direct deposit form, submit it according to the instructions provided. It may be required to provide a signed document or submit it electronically.

d. Check with Your Bank

After submitting the direct deposit form, it's wise to contact your bank. Confirm them that your account is set up to receive direct deposits and ensure there are no issues.

4. How Long Does it Take?

The time it takes to process your direct deposit can vary depending on a few factors. Typically, once you complete the setup and submit the necessary forms, it may take one to two pay cycles for the process to finalize.

However, some employers or organizations may have different timelines, so always ask about their specific processing guidelines.

5. Potential Issues and How to Avoid Them

While direct deposit is generally reliable, there can be a few potential issues that arise. It’s essential to be aware of these concerns and how to prevent them, ensuring your payments arrive smoothly.

Common issues include incorrect bank details, which could delay your payments or cause them to be redirected to the wrong account.

- Double-check your bank details before submitting the form.

- Notify your employer promptly if you change your bank account.

- Keep records of your direct deposit agreements and confirmation forms.

Taking these preventive measures helps maintain smooth transactions and ensures you receive your payments as expected.

6. Changing or Canceling Direct Deposit

There may come a time when you need to change or cancel your direct deposit arrangement. This can occur when you change jobs, switch banks, or want to modify the details of your account.

To change your direct deposit, you will generally need to submit a new direct deposit form with your updated bank information.

- Complete a new direct deposit form with your correct bank details.

- Submit the new form to your employer or payment source.

- Confirm the change with your bank to ensure future payments will be directed to the new account.

Being proactive in making these changes helps avoid any interruptions in your payment schedule.

Conclusion

In summary, setting up direct deposit is a simple yet crucial step toward managing your financial transactions efficiently. By understanding what direct deposit is and the steps involved in setting it up, you can benefit from timely payments and greater financial peace of mind.

Direct deposit not only saves you time but also enhances security in receiving payments. Make the most of this convenient payment method and ensure you keep track of your direct deposit details to avoid any potential issues.