While credit cards can offer incredible convenience and perks, they can also come with a minefield of terms and conditions that consumers need to navigate. Understanding credit card agreements is crucial to making informed financial decisions.

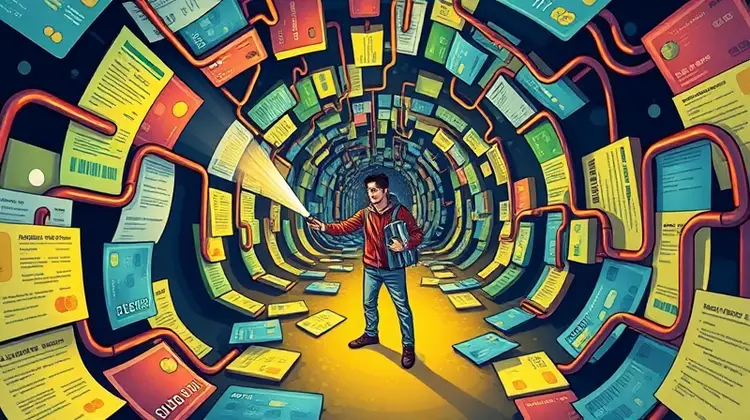

In this article, we'll break down the importance of reading and understanding these agreements. We'll also highlight key features and help you avoid pitfalls so you can maximize your benefits while minimizing costs.

The Importance of Credit Card Agreements

Credit card agreements are legal documents that outline the terms and conditions of using a credit card. Every cardholder receives an agreement that details important information such as the fees associated with the card, interest rates, and the terms related to rewards and benefits. Understanding these terms is vital for managing your finances effectively and avoiding unexpected charges.

Failing to read and comprehend your credit card agreement can lead to unfortunate financial consequences, including incurring high interest charges or being blindsided by fees. By taking the time to familiarize yourself with your credit card agreement, you can make smarter decisions about how to use your card and when to pay off your balance.

- It can prevent costly mistakes

- Helps you understand your rights and responsibilities

- Allows you to compare different credit cards more effectively

In conclusion, taking the time to read your credit card agreement is an essential step in responsible credit management. It empowers you as a consumer, enabling you to use your credit card wisely.

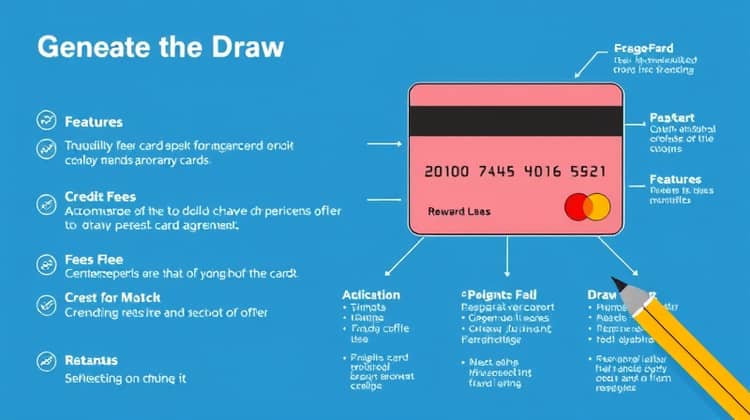

Key Features in a Credit Card Agreement

Every credit card agreement contains several key features that are essential for cardholders to understand. These features directly impact how you will use the card, what fees you'll incur, and how rewards can be earned and redeemed.

By recognizing these key components, consumers can make more informed decisions about their card choices and financial strategies moving forward.

1. Fees

Credit card fees can vary widely among different cards and can significantly impact your overall cost of borrowing. Common fees include annual fees, late payment fees, balance transfer fees, and cash advance fees. Being aware of these fees ahead of time can help you avoid unnecessary charges.

Understanding how and when these fees might apply helps you to determine if a specific credit card aligns with your financial habits and goals. It's beneficial to review these fees carefully before applying for a card or making any transactions.

In addition, some credit cards might offer a waived first year's annual fee or promotional rates that can make them attractive. However, this often comes with terms and conditions that need to be considered.

2. Interest Rates

Interest rates on credit cards are expressed in terms of APR (Annual Percentage Rate), which indicates how much will need to be paid in interest if the balance isn't paid in full. Typically, higher APRs could lead to significant charges if you carry a balance from month to month.

Credit cards often feature variable interest rates that can fluctuate with economic conditions or the prime rate, making it crucial for cardholders to understand the factors that influence interest rates and their potential impacts.

Some credit cards offer introductory 0% APR periods, a great opportunity for consumers looking to make large purchases or consolidate debt, but it’s essential to recognize how rates might change after these periods end.

3. Grace Period

A grace period is a time frame in which you can pay off your balance without accruing interest on new purchases. Understanding this period is important, as it allows for smart financial planning regarding when to make purchases and how to manage repayments effectively.

Not all credit cards come with a grace period, and if you do not pay your entire balance by the end of this period, you might be charged interest on the entire balance from the previous month, not just the new charges.

Knowing whether or not your card provides a grace period can help you avoid costly mistakes, particularly if you're planning to make large expenditures that you intend to pay off quickly.

4. Terms for Earning and Redeeming Rewards

Reward programs are often a major draw for credit card users. However, the value of rewards can vary widely among cards, and understanding how to earn and redeem them is critical to taking full advantage of your card's features.

Most reward systems have separate terms providing details on which purchases earn rewards points, how those points can be redeemed, and any expiration dates or limitations. Always review the fine print to maximize your rewards.

The Fine Print: Avoiding Pitfalls

While credit card agreements can seem straightforward, the fine print often hides important details that can lead to costly mistakes. It is imperative that consumers look beyond the attractive introductory offers and understand the terms that govern their card use.

For instance, while a credit card might offer a low introductory APR, the agreement may disclose that this rate lasts only for a specified duration, after which the rate will increase significantly. Awareness of these terms can prevent unpleasant surprises.

- Always read through the entire agreement before committing

- Pay attention to how fees and rates change over time

- Consider consulting a financial advisor for complex agreements

By being vigilant and reading the fine print, you can avoid pitfalls and use your credit card more effectively.

Your Rights Under the CARD Act

The Credit Card Accountability Responsibility and Disclosure Act (CARD Act) was enacted to promote transparency and protect consumers in credit card transactions. Under this act, cardholders have certain rights that ensure fair practices by credit card issuers.

For example, the CARD Act requires that card issuers provide clear disclosures regarding terms and conditions, including interest rates and fees, prior to the issuance of a card. Moreover, it mandates that cardholders be notified of any changes to their terms well in advance. Consumers should familiarize themselves with these protections to better safeguard their rights and interests.

Another cardinal rule of the CARD Act is that cardholders cannot be charged late fees unless they also paid the minimum payment due on time. These protections are designed to enhance financial literacy and empower consumers to manage their credit responsibly.

Understanding these rights can lead to more informed credit card usage, ensuring that consumers are both aware of their benefits and equipped to handle credit responsibly.

How to Change Your Credit Card Agreement

Sometimes, consumers may feel that their current credit card agreement does not suit their financial needs, whether due to fees, interest rates, or unsatisfactory rewards. Fortunately, there are options available to make changes to your agreement that can benefit you.

You can contact your credit card issuer directly and inquire about potential options to lower your rates or negotiate fees. Often, companies are willing to accommodate loyal customers, especially if you have a solid payment history.

Conclusion

In summary, understanding credit card agreements is not only a matter of compliance but a proactive step toward sound financial management. Cardholders who take the time to read and reflect on their agreements tend to make better financial choices and experience fewer pitfalls.

By being informed about fees, interest rates, grace periods, and rewards, you become empowered to take full advantage of your credit card while avoiding unexpected costs. Equip yourself with this knowledge, and make the most out of your credit card experience.