In today's consumer-driven society, premium credit cards have emerged as highly coveted financial tools. They promise a world of perks and benefits, appealing to individuals who seek luxury experiences and financial rewards. But with these enticing offers comes a hefty annual fee, prompting many potential users to ponder: Are premium credit cards worth the price? This article delves into the myriad benefits, the often-debated annual fees, and the overall value of these credit cards to help you make an informed decision.

As the market for credit products continues to expand, understanding the nuances of premium credit cards can empower you as a consumer. The right card can enhance your travel experiences, offer significant cashback rewards, and provide exclusive access to events or services that add tremendous value. However, it also requires careful consideration of your spending habits and lifestyle to truly benefit from these luxurious offerings.

Benefits of Premium Credit Cards

Premium credit cards often come bundled with a suite of benefits that can significantly enhance the cardholder's experience. From travel perks to cashback rewards, these cards are designed for individuals who maximize their spending potential. The right premium card can transform ordinary purchases into extraordinary rewards that align with your personal lifestyle and spending habits.

Additionally, premium credit cards frequently offer exclusive membership perks such as concierge services, travel insurance, and airport lounge access. These benefits can not only provide comfort during travel but also save you money in the long run when utilized effectively.

- High cashback rates on purchases

- Travel rewards and points that can be redeemed for flights or hotels

- Rental car insurance coverage

- Concierge services for booking reservations or tickets

- Access to exclusive events and experiences

While the allure of these benefits is strong, it is essential to evaluate whether they align with your spending patterns and lifestyle to avoid overextending yourself financially.

The Annual Fee Dilemma

One of the primary concerns surrounding premium credit cards is the annual fee, which can range from a few hundred to several thousand dollars. This fee can be a significant hurdle for many consumers who may question whether the benefits provided by the card are worth the investment.

Some argue that a high annual fee can be justified if the cardholder makes full use of the benefits offered. Others, however, maintain that for occasional users of credit cards, the fees can outweigh the rewards, making it an unjustifiable expense in their financial routine.

It's crucial to approach this dilemma with a clear understanding of what you will actually use. Calculating potential rewards against the annual fee can help you determine if a premium credit card is a suitable choice for you.

Evaluating the Value

When assessing the true value of a premium credit card, it is essential to look beyond just the annual fee and benefits. Each person's financial situation and spending patterns are unique, which means the value derived from a specific card will vary significantly between individuals.

- Calculate potential rewards based on projected spending

- Identify which benefits you will actually utilize

- Consider how often you travel or dine out

- Evaluate any associated fees other than the annual fee

By methodically evaluating these factors, you can better understand whether the investment in a premium credit card is sound based on your personal finances.

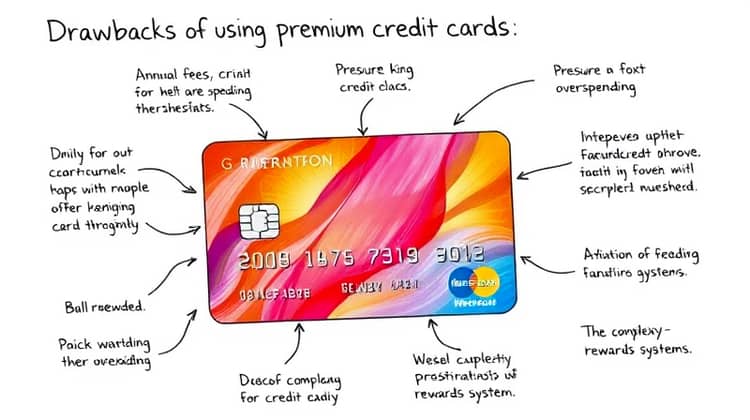

Potential Drawbacks

Despite the numerous benefits, premium credit cards also come with potential drawbacks that consumers should be aware of. For one, the high annual fee can pose a financial burden if the cardholder does not utilize the card frequently or competently enough to recoup the expense. Moreover, many premium cards have minimum spending requirements and other conditions that can be challenging to meet for some individuals.

In addition, the difficulty of accumulating points to qualify for certain rewards can leave some cardholders feeling disillusioned, particularly if they are not seasoned at managing their finances or travel effectively.

- High annual fees that may not justify the benefits

- Pressure to meet spending thresholds to gain rewards

- Potential for overspending to achieve higher rewards

- Complex reward systems that may confuse consumers

Consumers must weigh these potential drawbacks against the benefits to make an informed decision about whether to invest in a premium credit card.

Case Study: The Platinum Card® from American Express

The Platinum Card® from American Express represents a prime example of a premium credit card that garners much attention for its extensive benefits package. From complimentary access to airport lounges to trip cancellation insurance, this card is marketed toward frequent travelers and those who value luxury experiences.

- No foreign transaction fees

- 5x points on flights and hotels booked through Amex Travel

- Complimentary access to Amex Centurion Lounges

- Uber credits and airline fee credits

- Exclusive access to events via pre-sale and VIP packages

While many find the rewards compelling, it remains crucial to examine if the card’s steep annual fee can be justified by the value received based on personal usage.

Valuation:

Assessing the valuation of premium credit cards involves a careful analysis of both direct and indirect benefits. Potential cardholders must construct a clear picture of their own financial habits and obligations, particularly in terms of how often they travel or engage with spending categories that yield rewards.

The insights gained from the evaluation process can be transformative, leading to more informed decision-making when selecting a premium credit card that aligns with individual needs.

Tips for Managing Premium Credit Cards

Managing a premium credit card effectively requires discipline and strategic planning. As these cards often come with numerous perks, it’s easy to get carried away without a solid financial plan in place.

- Set a budget for your card use to prevent overspending

- Take advantage of all available perks and benefits

- Monitor your rewards and usage regularly

- Pay off the balance in full to avoid interest fees

Implementing these steps can help ensure that you maximize the benefits of holding a premium credit card while minimizing the potential pitfalls associated with them.

Conclusion

In summary, premium credit cards are laden with benefits that can be enticing for the right individuals. However, the financial implications, including generous annual fees and spending requirements, pose significant challenges that need careful consideration.

Ultimately, the worthiness of a premium credit card is subjective and varies greatly depending on personal financial situations and spending habits. By evaluating the benefits, understanding the associated costs, and managing the use of these cards strategically, consumers can determine whether the investment aligns with their financial goals.