Mobile check deposits have transformed the banking landscape, bringing convenience and efficiency to a once cumbersome process. As technology continues to develop, financial transactions have become quicker and safer, empowering individuals to manage their finances with ease. This article delves into mobile check deposits - how they work, their evolution, and the measures taken to ensure their security.

We will explore the traditional check deposit process, the rise of mobile check deposits, how they function, and the potential issues that can arise. Understanding all these facets will equip users with sufficient knowledge to make informed choices when it comes to check deposits.

Finally, we will address common concerns about the safety of mobile check deposits, and provide practical tips to navigate potential pitfalls in the mobile banking realm. Get ready to uncover the modern banking revolution!

The Evolution of Check Deposits

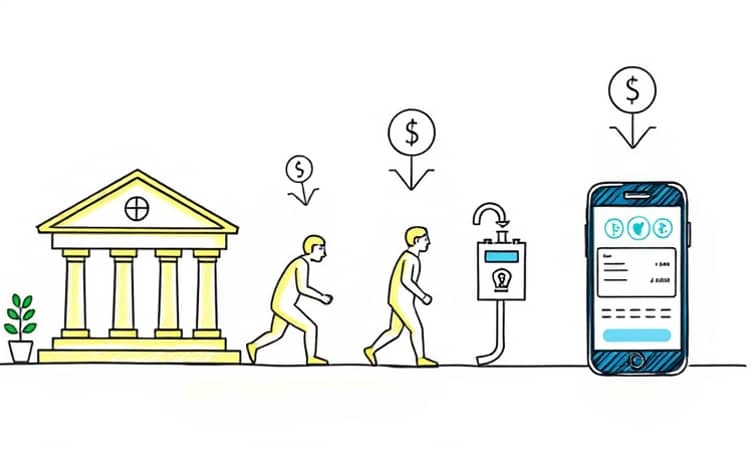

The practice of depositing checks is as old as banking itself, designed to facilitate the transfer of funds between individuals and businesses. Traditionally, this process required the physical presence of a check at a banking institution, which often meant long lines and time-consuming transactions. Over the years, various innovations such as ATMs and electronic funds transfer have simplified aspects of banking, yet the check deposit process remained relatively unchanged for a long time.

However, with the rise of smartphones and advancements in camera technology, banks began to explore the concept of mobile check deposits. This new functionality allowed users to deposit checks from their mobile devices, effectively minimizing the need for physical bank trips. It presented an opportunity for banks to enhance customer service and attract tech-savvy consumers looking for convenience in their banking activities.

Thus, mobile check deposits emerged as a viable alternative, fundamentally altering the dynamics of how individuals handle their checking transactions. This evolution reflects our broader cultural shift toward digital solutions in all areas of life, including finance.

The Traditional Check Deposit Process

Traditionally, depositing a check involved a straightforward yet often time-consuming process. A customer would need to physically visit their bank or credit union branch, fill out a deposit slip, and present the check to a teller. This meant setting aside time from one’s daily routine to ensure that funds were credited to their account promptly.

In addition to in-person deposits, many individuals opted to utilize ATMs for check deposits. This method, while more convenient than waiting in line at a bank, still required the customer to travel to a machine, navigate through various prompts, and securely store the check until it was processed. The waiting period for funds to clear could range from one business day to several days, depending on the bank’s policies.

Moreover, check deposits often carried risks and inconveniences, such as the potential for checks to be lost or misplaced during transit. Many customers were left unsure about the status of their funds, leading to further frustration with traditional banking processes. All these factors highlighted the need for a more efficient and user-friendly deposit solution, paving the way for the advancement of technology in banking.

Ultimately, the traditional check deposit system presented several limitations that mobile banking technology now seeks to address, creating a seamless experience for users worldwide.

The Rise of Mobile Check Deposits

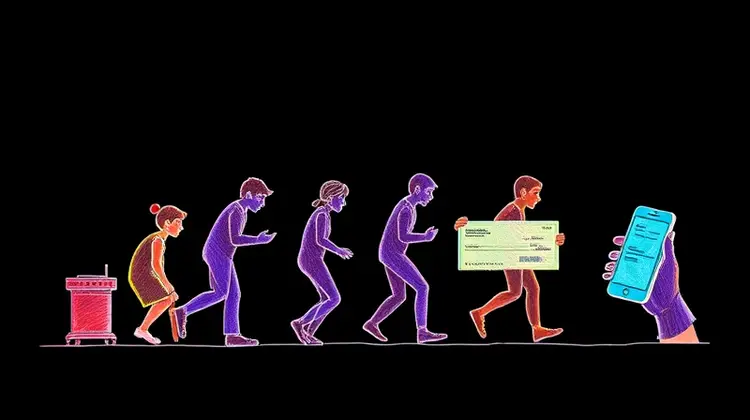

As smartphones became ubiquitous, banks recognized the potential to leverage mobile technology to streamline the check deposit process. In the early 2010s, major financial institutions began rolling out mobile check deposit features within their banking apps, enabling customers to deposit checks with a few taps on their screens. This innovation eliminated the need for physical bank visits and positioned banks to better meet the demands of increasingly busy customers.

The appeal of mobile check deposits quickly gained traction among consumers, driven by the convenience of depositing checks from anywhere at any time. Users could snap a picture of the front and back of their check, submit it through their banking app, and watch as the funds were credited to their account, all without having to leave their homes. This shift not only improved customer satisfaction but also influenced other banks to adopt similar services, thus expanding the technology's reach.

With the rise of mobile check deposits, banks not only modernized their services but also contributed to a broader trend of digital bank management. As more people began to embrace mobile banking, the landscape of personal finance was revolutionized, helping to shape the future of how customers interact with their financial institutions.

- User-friendly interfaces in banking apps

- Instant fund availability compared to traditional methods

- Flexible deposit options regardless of location

This evolution towards mobile deposits represents a significant turnaround in customer service, showcasing how banking institutions have adapted to the needs of modern consumers. By capitalizing on technological advances, banks reinforce their commitment to providing innovative solutions that enhance the customer experience.

As we delve deeper into mobile check deposits, it becomes essential to understand not just how they function but also the safety measures integrated into these processes to protect user information and funds.

How Mobile Check Deposits Work

Mobile check deposits are a straightforward yet effective way of processing checks without visiting a bank. The procedure begins when a user opens their banking app, taps the mobile check deposit option, and follows the prompts to take photos of their check. This is facilitated by the app's built-in camera functionality, which ensures that images are clear and legible.

Once the photos are captured and the required information entered, the app sends the check images securely to the bank for processing. Upon receipt, the bank verifies the images, checks for accuracy, and processes the deposit, often providing immediate or near-immediate credit to the user’s account. This entire process simplifies banking, making transactions both seamless and efficient.

- Easy-to-use app interfaces increase accessibility

- Photographic verification ensures accuracy

- Remote submission eliminates trips to the bank

After successful submission, most checks have a clearance time of one business day, but banks may vary in their processing times. Users can track the status of their deposits through their banking apps, adding an extra layer of convenience in ensuring funds are accessible whenever needed.

Moreover, this method significantly decreases the physical handling of checks, reducing the chance of loss or theft during transit, further enhancing the safety of financial transactions in today’s digital-minded world.

Security Measures

Banking institutions have implemented a variety of security measures to protect customers using mobile check deposits. One primary concern is ensuring that transmitted data is secure and cannot be intercepted by unauthorized parties. Banks employ state-of-the-art encryption protocols to safeguard personal information and transaction details during the entire deposit process.

Additionally, various authentication methods, such as two-factor authentication or biometric checks like fingerprints or facial recognition, further strengthen the security framework surrounding mobile transactions. These measures make it increasingly difficult for hackers to access sensitive information, providing users with greater peace of mind.

- Encryption of transmitted data

- Biometric verification processes

- Real-time monitoring for suspicious activities

These combined efforts reveal how seriously banks take the security of mobile check deposits. By investing in cutting-edge technology and practices, users can confidently manage their finances without having to compromise safety.

Are Mobile Check Deposits Safe?

While the introduction of mobile check deposits has greatly streamlined banking practices, many customers remain concerned about their safety. It’s natural to question the security of digitally managing finances, especially when physical checks and personal information are involved. However, the security measures put in place by banking institutions are designed to mitigate these risks effectively.

Indeed, cybersecurity has become a top priority, with banks continuously evolving their protocols to stay ahead of potential threats. By leveraging advanced technologies and maintaining transparency with users about their security practices, banks work tirelessly to ensure that deployed systems resist tampering and fraud.

Common Issues and How to Avoid Them

Despite the many benefits of mobile check deposits, users may experience some common issues. One such challenge can be the improper capture of check images, leading to errors or delays in processing. Users may inadvertently take pictures at awkward angles or under poor lighting, which can affect the quality of the images submitted. Thus, ensuring well-lit environments and following app guidelines become critical steps in preventing this issue.

Another concern is the confusion surrounding deposit limits, which often vary from bank to bank. Users should familiarize themselves with their bank’s policies regarding the maximum amount that can be deposited through mobile methods to avoid declined transactions or inconsequential delays.

- Ensure clear and straight images of checks are captured

- Be aware of deposit limits set by the bank

By being mindful of these practices and educating oneself about the mobile check deposit process, users can maximize the efficiency and reliability of their transactions, minimizing potential pitfalls.

Conclusion

Mobile check deposits have profoundly changed how individuals engage with and manage their finances. This evolution represents a significant departure from traditional methods that once relied heavily on physical banking visits. In a world where convenience is key, mobile check deposits offer financial freedom, allowing users to complete transactions quickly and securely from almost anywhere.

The ongoing focus on security and improved features reflects the banking industry’s commitment to adapting to modern consumer needs. Above all, increased security measures and user-friendly interfaces have made mobile banking a trustworthy and practical alternative to in-person deposits. As the technology continues to advance, we can expect mobile check deposits to become even more seamless and integrated into daily financial interactions.

Lastly, understanding how mobile check deposits work, the security measures in place, and common pitfalls ensures consumers can make the best use of this modern banking feature. As you navigate through this increasingly digital financial landscape, mobile check deposits will continue to be a valuable tool in managing your personal finances.