In today's financial landscape, many borrowers find themselves struggling to keep up with their mortgage payments. Whether due to unforeseen circumstances such as job loss, medical emergencies, or economic downturns, the burden of high monthly payments can lead to anxiety and potential foreclosure. Fortunately, loan modifications offer a viable solution to help these borrowers manage their financial obligations more effectively and avoid losing their homes.

A loan modification is a change made to the terms of an existing loan by the lender, which can alter the monthly payments, interest rates, or even the length of the loan. This not only helps make payments more affordable but can also provide borrowers with the relief they need to stabilize their financial situations. Understanding the ins and outs of loan modifications can empower borrowers to make informed decisions regarding their mortgage.

In the following sections, we will explore the various aspects of loan modifications, including why borrowers seek them, the common types available, the process involved, and potential challenges they may encounter.

Understanding Loan Modification

Loan modification is a process that allows borrowers to change the terms of their existing loan agreement. This is particularly beneficial for individuals who are facing financial difficulties but want to avoid foreclosure. By altering the terms such as interest rates or loan duration, borrowers can make their monthly payments more manageable, thereby improving their overall financial situation.

Essentially, a loan modification aims to provide relief to borrowers who are struggling to meet their current mortgage obligations. This relief can manifest in different ways, including lower monthly payments, reduced interest rates, or an extension of the loan term. Understanding the various facets of loan modifications is crucial for borrowers considering this option, as it can significantly affect their financial future.

It’s important to recognize that a loan modification is not a one-size-fits-all solution. Every borrower’s situation is unique, and the terms of any modification will vary based on the individual’s financial circumstances, the lender’s policies, and the specific type of modification being sought.

Reasons Borrowers Seek Loan Modifications

There are numerous reasons why borrowers may seek loan modifications. The primary driver typically lies in financial hardship; situations such as job loss, divorce, health-related issues, or significant unexpected expenses can make it increasingly difficult for borrowers to meet their mortgage obligations. In these cases, modifying the loan can help them retain their homes without the added stress of unaffordable payments.

Additionally, economic downturns can affect a significant number of borrowers simultaneously, leading to widespread need for modifications. When property values decline, borrowers may find themselves in a position where they owe more on their mortgage than their home is worth, a situation known as being 'underwater.' This can further incentivize them to seek a loan modification to avoid foreclosure.

Common Types of Loan Modifications

Loan modifications can take several forms, each designed to help borrowers in different ways. Understanding these types can help borrowers choose the option that best suits their needs, whether through reduced payments or other forms of assistance. Common types of loan modifications include changes to interest rates, adjustments to the remaining term of the loan, and principal forbearance.

Another common type involves a temporary modification, which allows borrowers to make reduced payments for a set period before reverting to the original terms. This can be especially useful for those who anticipate a short-term financial setback.

- Lowering the interest rate on the loan

- Extending the length of the loan term

- Reducing the principal amount owed

- Switching from an adjustable-rate mortgage to a fixed-rate mortgage

These options help borrowers tailor their loan terms to better fit their current financial situations, potentially enabling them to manage their circumstances more effectively.

The Loan Modification Process

The loan modification process typically begins when a borrower contacts their lender to discuss their financial difficulties. This initial communication is crucial, as it sets the stage for potential negotiation of more favorable loan terms. Borrowers should be prepared to provide documentation that outlines their financial situation, including income, expenses, and reasons for seeking a modification.

Once the lender has received the necessary information, they will review the borrower’s application and determine whether or not to modify the loan. It's essential for borrowers to remain engaged throughout this process, as communication can significantly affect the outcome.

- Gather necessary financial documents

- Submit a formal loan modification application

- Wait for the lender's review and decision

- Negotiate new terms if approved

Staying proactive and responsive can increase a borrower's chances of success in obtaining a loan modification that meets their needs.

Challenges and Considerations

While loan modifications can provide valuable relief for struggling borrowers, there are also challenges and considerations to keep in mind. One of the significant hurdles can be the lengthy process involved; depending on the lender, approval may take time, leaving borrowers in a state of uncertainty. This delay can cause additional financial strain if immediate action is needed.

Borrowers may also encounter difficulties in providing the necessary documentation or understanding the specific requirements of their lender. Some lenders have stringent criteria for approving modifications, which may not be met by all borrowers.

- Potential for a temporary financial strain during the modification process

- Risk of rejection if documentation is insufficient

- Possibility of negative impact on credit score

- Lender's criteria may change frequently

Being aware of these challenges can help borrowers prepare and approach the loan modification process with realistic expectations.

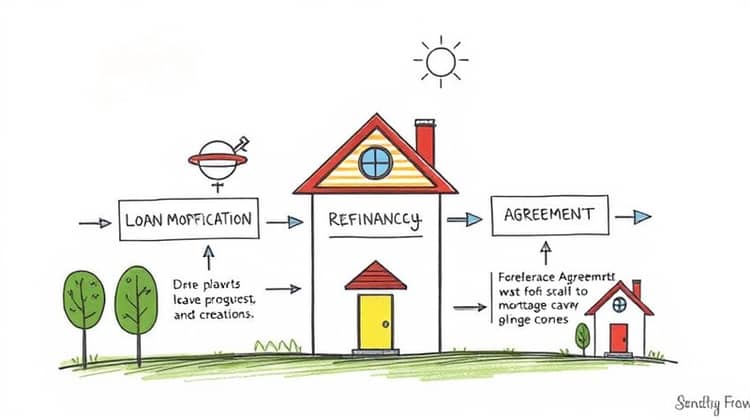

Alternatives to Loan Modification

While loan modifications can be an excellent option for many, there are also alternatives that borrowers may want to consider. For instance, refinancing the mortgage can be a way to secure lower payments or better terms, provided that the borrower has adequate equity and credit standing. Refinancing essentially involves taking out a new loan to pay off the existing mortgage, which can provide significant savings in the long run.

Another alternative is pursuing a forbearance agreement, which allows borrowers to temporarily reduce or suspend payments without modifying the loan. This option can be particularly useful for those facing short-term financial hardships, enabling them to keep their home while working towards improving their financial situation.

- Refinancing the existing mortgage

- Pursuing a forbearance agreement

- Seeking financial counseling or assistance programs

- Selling the property as a last resort

Exploring these alternatives can give borrowers additional options to navigate their financial challenges and maintain homeownership.

Conclusion

In conclusion, loan modifications serve as a valuable resource for borrowers struggling with their mortgage payments. By understanding the various types available and the processes involved, borrowers can better navigate their situations and potentially save their homes. Loan modifications offer flexibility and could lead to more manageable payments, making them a crucial concern in today's economic climate.

However, it is essential for borrowers to remain aware of the challenges that may be associated with pursuing a modification, as well as considering alternatives that may suit their needs. Proper research, open communication, and proactive engagement with lenders are vital components for successfully obtaining a loan modification.