Joint bank accounts are a common financial solution for couples and family members looking to manage their finances together. Sharing a bank account can streamline bill payments, savings goals, and daily expenses, but it also requires clear communication and trust between account holders. This article aims to explore the benefits and risks associated with joint bank accounts, as well as provide valuable tips and factors to consider before taking this step.

With a deeper understanding of what joint bank accounts entail, individuals can make informed decisions that best suit their financial situations. Establishing a joint account can be a positive step toward financial unity, but it is essential to weigh potential drawbacks alongside the advantages. We will also discuss effective management strategies to ensure a healthy financial partnership.

Pinpointing the right approach to joint finances can aid in building stronger relationships. By managing a joint bank account responsibly, account holders can avoid misunderstandings and conflicts, paving the way for a successful joint financial journey.

Benefits of Joint Bank Accounts

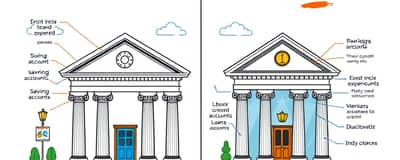

Opening a joint bank account can be a practical solution for couples or family members who share financial responsibilities. One of the most significant benefits is the ease of managing shared expenses, such as household bills, groceries, and savings for future endeavors like vacations or home purchases. This shared financial platform can promote accountability and transparency, enabling both parties to contribute to their financial goals actively.

Moreover, joint bank accounts can simplify the financial process by allowing direct access for both account holders. Instead of navigating multiple individual accounts, a joint account centralizes funds, making it easier to track spending and manage budgets collaboratively.

- Simplifies the management of shared expenses

- Promotes financial transparency and accountability

- Facilitates savings for joint goals

- Improves budgeting and tracking of finances

- Potential for better interest rates or account benefits

With these advantages in mind, many people find joint bank accounts to be a convenient way to merge their financial efforts. However, it is essential to consider the potential risks that can impact both account holders.

Risks of Joint Bank Accounts

While joint bank accounts have their advantages, there are also significant risks to consider. A notable downside is the potential for disputes over money management, spending habits, or differing financial philosophies. One individual's reckless spending can directly affect the financial stability of both account holders, leading to tension and mistrust.

Factors to Consider Before Opening a Joint Bank Account

Prior to opening a joint bank account, individuals should carefully assess their financial compatibility and communication styles. Understanding each other's perspectives on money management is crucial to avoid conflicts down the road.

- Evaluate your financial habits and goals together

- Discuss how you plan to handle expenses and responsibilities

- Set clear expectations for contributions and withdrawals

- Determine how you will manage disagreements regarding finances

By addressing these factors beforehand, potential account holders can ensure they are on the same page, which is essential for a successful financial partnership.

How to Manage a Joint Bank Account Safely

To effectively manage a joint bank account without complications, clear communication and trust are paramount. Regularly discussing financial activities and maintaining transparency can help both account holders feel secure and informed about their shared finances. Additionally, setting a budget and sticking to it can prevent misunderstandings and encourage disciplined spending habits.

It is also advisable to schedule periodic check-ins to review the account statements together. This practice fosters financial dialogue and allows both parties to address any concerns or discrepancies proactively.

- Maintain regular communication about finances

- Establish budget guidelines together

- Review account activities periodically

- Set limits on significant withdrawals or expenditures

By implementing these management strategies, both account holders can help ensure the joint account remains a source of support rather than conflict. Taking responsibility and being open in financial matters are key elements in preserving a positive financial relationship.

Conclusion

In conclusion, joint bank accounts can provide numerous benefits to individuals who are ready to share their financial lives. They facilitate joint expense management, promote financial transparency, and help achieve shared savings goals. However, it is essential to navigate the associated risks carefully, such as the potential for financial disagreements and differing spending habits.

By preparing adequately and maintaining open lines of communication, account holders can cultivate a financially harmonious relationship that benefits both parties. Furthermore, being disciplined and ensuring regular discussions about finances can minimize misunderstandings and conflicts, reinforcing the partnership.

Ultimately, deciding to open a joint bank account should be approached with thoughtfulness and respect for each individual's financial outlook.