Investing in the stock market can often seem daunting, especially for beginners who might not know where to start. With a plethora of investment vehicles available, it's crucial to find a method that fits your financial goals and risk tolerance. One increasingly popular option is investing in index funds.

Index funds are a type of mutual fund designed to replicate the performance of a specific market index, such as the S&P 500. They offer a unique blend of diversification, ease of management, and lower fees compared to actively managed funds. In this article, we'll take a closer look at what index funds are, their benefits, how they work, and provide a comprehensive guide for those considering investing in them.

Whether you're saving for retirement, a home purchase, or simply looking to grow your wealth, understanding index funds can empower you to make informed investment decisions and improve your financial future.

What Is an Index Fund?

An index fund is a type of investment fund that specifically aims to match or track the components of a market index. Unlike actively managed funds where a fund manager makes decisions on which securities to buy and sell, index funds follow a passive investment strategy. This means they simply replicate the performance of the selected index, giving investors broad market exposure.

The concept behind index funds is relatively straightforward: by pooling money from multiple investors, the fund can purchase a variety of securities that make up the index. This strategy provides instant diversification at a lower cost, which is especially beneficial for beginner investors who may not have the capital to build a diverse portfolio on their own.

As the market fluctuates, the value of the index fund rises or falls in accordance with the performance of the index it tracks. This makes index funds a reflective investment, mirroring the ups and downs of the overall market rather than trying to outperform it. This characteristic is a significant reason why many investors are drawn to index funds.

- Accessibility: Index funds can be easily accessed through most investment accounts, including retirement accounts. They often have low minimum investment requirements or none at all.

- Cost-effectiveness: Index funds typically charge lower fees than actively managed funds, as they do not require extensive research or active management.

- Diversification: By investing in an index fund, you can instantly hold a stake in a wide variety of companies across different sectors, reducing your overall investment risk.

- Simplicity: Index funds follow a straightforward investment strategy, making them easy to understand for beginners.

- Performance: Historically, index funds have performed better than the majority of actively managed funds over the long term.

Index funds come in various forms, such as mutual funds and exchange-traded funds (ETFs). They appeal to both novice and seasoned investors alike due to their straightforward investment strategy and lower costs. Understanding the features and mechanisms of these funds is essential for making informed investment choices.

As you explore opportunities for index fund investments, consider your financial goals, risk tolerance, and overall investment strategy to best leverage the advantages they offer.

Benefits of Investing in Index Funds

Investing in index funds has gained significant popularity due to the various benefits they provide. These funds not only simplify the investing process but also cater to a range of investor preferences and strategies.

- Lower fees due to passive management.

- Reduced investment risk owing to diversification.

- Historical performance exceeding many actively managed funds.

- Easy to set up and manage compared to individual stock picking.

Overall, index funds represent a smart investment choice for individuals who want to enter the financial markets with a robust, low-cost option. Their performance and simplicity effectively help investors build wealth over time.

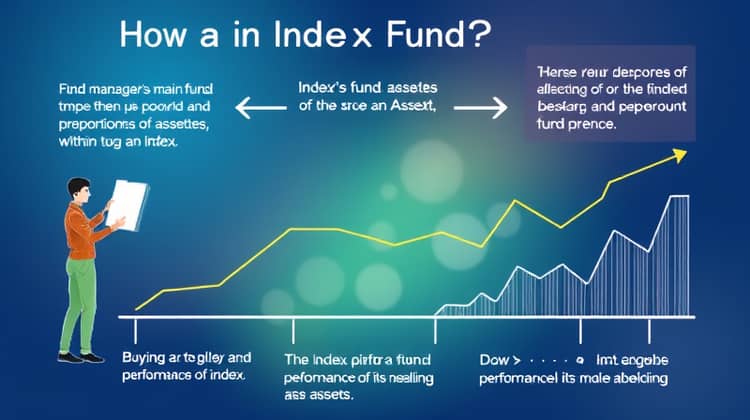

How Do Index Funds Work?

Index funds operate by investing in a representative sample of securities that compose the index they aim to replicate. For example, an S&P 500 index fund will invest in the stocks of the 500 companies listed in that index. This buys a portion of all those stocks, offering market-like returns.

The fund manager's role is primarily to ensure that the fund maintains the same proportions of assets as the index. They do not make decisions based on market research or speculation; instead, they buy and hold the stocks within the index, rebalancing only when necessary.

- Select an index to track, such as the S&P 500 or the Nasdaq 100.

- The fund manager purchases the specified proportion of stocks within that index.

- The fund’s performance reflects the collective performance of its underlying assets, moving in line with the market index it tracks.

By understanding how index funds work, investors can make better-informed choices on whether to include them in their portfolios, considering factors like their long-term investment strategy and objectives.

Types of Index Funds

There are several different types of index funds available, catering to various investment styles and goals. Understanding these distinctions can help investors choose the best option for their specific needs.

Some index funds may focus on specific sectors, while others track broader market indices; thus, they provide varying levels of volatility and risk.

- Broad market index funds: Typically focus on a large market index, such as the S&P 500 or the Total Stock Market Index.

- Sector index funds: Target investments in specific industry sectors, like technology, healthcare, or energy.

- International index funds: Focus on stocks from countries outside the investor’s home country, providing exposure to global markets.

- Bond index funds: Invest in fixed-income securities, allowing investors to access the bond market through a single vehicle.

Identifying the type of index fund that aligns with your financial goals and risk tolerance is important to ensure a well-rounded investment portfolio.

Challenges and Risks

While index funds offer numerous benefits, they also come with their own set of challenges and risks that investors should be aware of. Being mindful of these risks can help in making better investment decisions.

Market fluctuations can significantly affect index funds, as they are designed to track the market rather than outperform it. If the entire market declines, so will the value of an index fund.

- Limited flexibility due to passive investment strategy.

- Exposure to market downturns when the associated index drops.

- Lack of active management during volatile market conditions.

Investors should weigh these challenges against the benefits before deciding to invest in index funds. A well-informed understanding of the market dynamics can help mitigate some of these risks.

How to Invest in Index Funds

Investing in index funds is an accessible process even for beginners. Opening an investment account and selecting the right index fund can be done quite easily, paving the way for building a diversified portfolio from the start.

The first step is to choose a brokerage or investment platform that offers access to index funds. There are myriad options, including traditional brokerages and robo-advisors, both of which have their unique features and benefits.

- Research index funds that match your investment goals and risk tolerance.

- Consider the expense ratios and performance history when evaluating funds.

- Decide between mutual funds or ETFs, depending on your trading preferences and liquidity needs.

By following these steps, investors of all experience levels can confidently navigate the process of investing in index funds and establish a solid foundation for their financial future.

Conclusion

Index funds can serve as a cornerstone for many investors' portfolios due to their inherent benefits of diversification, cost-effectiveness, and ease of management. For beginners especially, they simplify the investing process and offer a lower-risk alternative to streaming individual stocks.

As you embark on your investment journey, understanding index funds and how they can fit into your overall financial strategy is crucial. By leveraging the advantages of index funds, you position yourself to benefit from the growth potential of the stock market while controlling costs.