Starting a business can be an exhilarating and terrifying experience. Whether you’re launching a startup or expanding an existing business, securing a business loan is often a key step in this journey. Understanding the loan application process can help ease your anxiety and ensure you are well-prepared for what lies ahead.

In this article, we’ll break down the process into five essential steps. By following these guidelines, you can increase your chances of obtaining the funding you need to bring your business dreams to fruition.

Step 1: Gather Your Financial Documents

When it comes to applying for a business loan, the first thing you need to do is gather all your financial documents. Lenders want to see your financial history and current financial stability. Having these documents ready will not only speed up the process but also demonstrate your professionalism and preparedness.

Common documents you will need include bank statements, tax returns, profit and loss statements, and any other relevant information that reflects your business's financial health.

- Bank statements (typically the last three months)

- Business tax returns (last two years)

- Personal tax returns (last two years)

- Profit and Loss statements

- Balance sheets

Having all these documents organized will make the application process much smoother. If you’re unsure about any specific documents, check with your lender, as different institutions may have varying requirements.

Step 2: Review Your Credit Score

Your credit score is a crucial factor that lenders look at when making their decision. A high credit score indicates that you are a reliable borrower, which can lead to better loan terms and lower interest rates. Therefore, it’s essential to review your credit score before applying for a loan.

You can obtain your credit report for free from various online services. Look over your report for any inaccuracies that might negatively impact your score. If you find any errors, take the necessary steps to report and correct them.

Understanding what your credit score means in context can help you set realistic expectations for your loan application. For instance, a score above 700 is typically considered good, whereas a score below 600 might make it challenging to secure favorable loan terms.

- Obtain your credit report from a credible source

- Check for inaccuracies and dispute them if necessary

- Understand your credit score range and how it affects loan options

After reviewing your credit score, consider taking steps to improve it if necessary. This could include paying down existing debts or ensuring that you make all future payments on time. A higher credit score can be the difference between getting the loan you want and getting turned down.

Step 3: Explore Different Loan Options

There is a wide range of loan options available to business owners, each with its own set of terms and conditions. From traditional bank loans to alternative financing options such as peer-to-peer lending and crowdfunding, exploring these options can provide you with a clearer picture of what is available to you.

When looking at different options, consider interest rates, repayment terms, and eligibility requirements. Some loans may be designed for startups, while others may cater to established businesses looking for expansion funds. Research each option thoroughly before making a decision.

Additionally, consider the amount of money you need and how quickly you need it. Some lenders offer quicker access to funds but may charge higher interest rates, while others may take longer but offer more favorable terms.

Step 4: Create a Detailed Business Plan

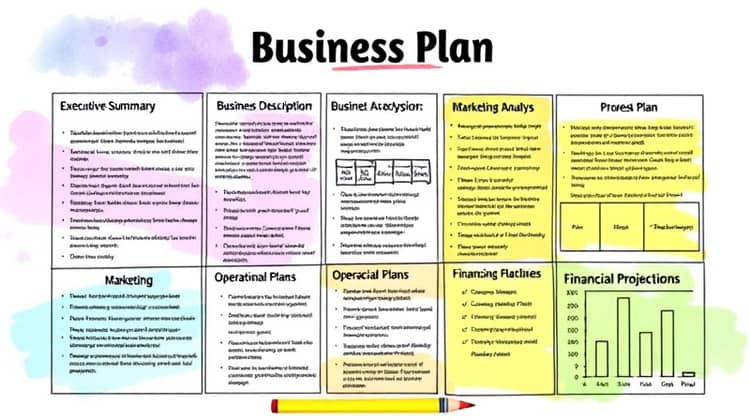

A well-crafted business plan is essential when applying for a business loan. It serves as a roadmap for your business and convinces lenders that you have thought through your goals and how to achieve them. Your business plan should outline your business objectives, market analysis, strategies, and financing needs.

Structure your business plan to include an executive summary, a description of your business and its products or services, a market analysis, a marketing plan, an operational plan, and detailed financial projections. Including clear goals and metrics will help lenders see that you are serious and committed to your business's success.

Having a detailed business plan demonstrates to lenders that you're not only organized but also equipped to manage the funds you are requesting. It sets you apart from other borrowers who may not be able to showcase a clear strategy for their business.

Take time to review and refine your business plan before submission. It may also be worthwhile to seek feedback from business mentors or advisors who can provide valuable insights.

Step 5: Submit Your Application

Once you have gathered your documents and have a solid business plan, it’s time to submit your application. This process can vary significantly between lenders, so be sure to carefully read through their application requirements and follow the instructions provided.

Some lenders may allow you to apply online, while others may require you to submit hard copies. Be meticulous about filling out your application to avoid any mistakes that could delay the process.

After submission, be prepared to answer any follow-up questions from your lender. They may want more details about your business or finances, so being available and responsive is crucial to expedite the approval process.

Finally, once approved, carefully review the loan terms before signing. Pay attention to interest rates, repayment terms, fees, and any other agreements to make sure they align with your business needs.

Conclusion

Applying for a business loan can be a daunting process, but by following these five essential steps, you can significantly improve your chances of success. Remember, preparation is key; having your documents in order and a strong business plan can set you apart from the competition.

Ultimately, securing a loan not only provides the necessary funds to grow your business but also opens up new opportunities for you as an entrepreneur. Stay determined, and don’t hesitate to seek guidance along the way.