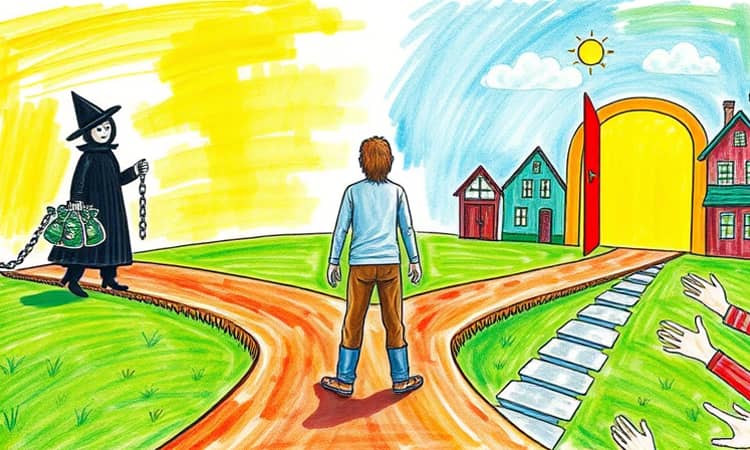

Predatory lending robs individuals of financial security and hope, entangling them in debilitating debt. This guide equips you with the knowledge to spot unfair loan terms and protect your future.

Understanding Predatory Lending

Predatory lending refers to unethical or abusive financial practices that disadvantage borrowers. These loans often carry exorbitant fees and punitive rates, hidden clauses, and deceptive loan agreements hidden deep in the fine print.

At its core, predatory lending exploits information asymmetry and desperation. Borrowers may feel pressured by aggressive salespeople or lured by promises of quick cash. The result is a cycle of debt that can strip away home equity, ruin credit scores, and erode hope.

Many victims report feeling overwhelmed by confusing jargon and last-minute changes. Lenders may use complex legal language to mask the true cost of borrowing, leaving unsuspecting individuals vulnerable to unmanageable repayments.

By shining a light on these practices, borrowers can reclaim agency and demand the transparency they deserve.

Who Is Most at Risk?

Certain groups face a higher likelihood of encountering exploitative lenders. Awareness of these vulnerabilities can guide targeted prevention efforts.

- Minority groups, particularly Black and Latino communities

- The elderly, living on fixed incomes

- Individuals with limited credit history or low scores

- Those in low-income neighborhoods with fewer banking options

- People lacking financial education or support networks

These populations often encounter predators who promise fast approval and disregard their long-term welfare. The fallout can include foreclosure, vehicle repossession, or loss of critical savings.

Communities can come together to share knowledge, host free workshops, and build peer networks that spread awareness and foster resilience against these deceptive schemes.

Key Characteristics and Red Flags

Predatory loans share common traits that signal danger. By learning these warning signs, you can avoid harmful agreements before signing.

Hidden fees, such as processing or administrative charges, can add thousands of dollars to your balance. Always ask for an itemized breakdown, and verify each cost against market averages to ensure fairness.

Mandatory arbitration clauses strip away a critical avenue for justice, forcing disputes into private proceedings that favor lenders. Recognizing this red flag is essential to preserving your legal rights.

Similarly, balloon payments due at the end of a loan term can trap borrowers in a vicious cycle, as they scramble to refinance under worse conditions or abandon the property entirely.

Real-World Impact and Statistics

Predatory lending is not a niche issue: it affects millions and costs billions. In 2022, payday lenders nationwide collected over $2.4 billion in fees, with Texas consumers alone paying $1.3 billion. Studies indicate up to unforgiving prepayment penalties and fees in 80% of subprime mortgages, hiding charges that borrowers rarely anticipate.

Consider the story of Maria, a single mother who refinanced her home to cover medical bills. Despite promises of lower payments, her loan carried undisclosed insurance fees that ballooned her balance. Within months, she faced foreclosure as payments grew unaffordable.

These practices erode community wealth, especially in marginalized areas where access to fair credit is limited. Families lose homes, vehicles, and the emotional security that financial stability provides.

Awareness of these systemic challenges empowers advocates to push for reform, rally neighbors, and support policy changes that protect vulnerable populations.

Protecting Yourself: Practical Strategies

Empowerment begins with informed decision-making. The following steps can help you avoid falling into predatory lending traps and preserve your financial stability.

- Compare offers from multiple reputable lenders before deciding

- Read all documents thoroughly; never sign incomplete forms

- Request transparent, written disclosures of fees and repayment schedules

- Avoid lenders who pressure you to borrow more than needed

- Seek advice from nonprofit credit counselors or legal aid

- Maintain clear records of all communications and contracts

When evaluating loan options, take the time to calculate the total cost of borrowing over the loan’s lifetime. Simple interest calculators and free online tools can reveal the true financial impact.

Nonprofit credit counseling agencies offer free or low-cost sessions to review your finances, negotiate with lenders, and develop realistic repayment plans. These services can save you from costly mistakes and provide ongoing support.

Regulatory and Community Actions

Government bodies and community organizations play a crucial role in curbing predatory lending. The U.S. Department of Justice prosecutes the worst offenders, and agencies like the Consumer Financial Protection Bureau enforce truth-in-lending regulations.

Key legislative milestones, including the Dodd-Frank Act, strengthened oversight and required clearer disclosure of loan terms. However, enforcement gaps remain, especially at the state level where regulations vary widely.

Advocacy groups recommend supporting bills that cap interest rates, ban unfair fees, and eliminate mandatory arbitration clauses. Engaging local representatives and attending hearings can amplify these voices.

Community-led financial education programs—hosted in schools, churches, and community centers—build long-term resilience. Volunteers can teach budgeting, explain credit reports, and offer mock loan analyses to help peers spot risky offers.

By combining top-down regulation with ground-level empowerment, society can erect robust defenses against predatory lenders, ensuring fair access to credit for all.

Every individual who learns to question suspicious terms and share that knowledge becomes a crucial link in the chain of protection. Together, we can transform financial landscapes from exploitative to equitable.

Stay vigilant, seek clarity, and demand transparency. Your financial well-being is worth every moment spent defending it.