People often seek safer investment options that provide them with better returns compared to traditional savings avenues. High-yield savings accounts (HYSAs) have emerged as a popular choice in this regard. As interest rates have fluctuated over the years, these accounts offer an attractive alternative for individuals looking to grow their savings while maintaining easy access to their funds. This article dives into everything you need to know about high-yield savings accounts, including their benefits, how to choose the right one, and the steps to open an account.

While HYSAs are offered by various banks, including online-only institutions and traditional banks, the rates and features can vary significantly. Understanding these differences can empower consumers to make informed decisions that align with their financial goals. Additionally, high-yield accounts typically provide a higher interest rate than standard savings accounts, making them an ideal option for individuals intent on maximizing their earnings on saved funds.

In the current financial landscape, where inflation poses a significant challenge, the need for effective savings strategies has never been more pressing. By exploring and utilizing high-yield savings accounts, individuals can enhance their financial capabilities and create a safety net that ensures long-term stability and growth. This article outlines the essentials of high-yield savings accounts, enabling readers to navigate towards smarter savings.

Understanding High-Yield Savings Accounts

High-yield savings accounts are financial products that typically offer higher interest rates than conventional savings accounts. They are designed to encourage saving while providing a more attractive yield on deposits. This distinction makes them particularly appealing for individuals who want to earn interest on their savings without exposing themselves to the higher risks associated with investments in the stock market.

These accounts are typically offered by online banks or credit unions, which can afford to provide higher rates due to lower overhead costs. The significant variance in rates among different institutions means that consumers should shop around to find the best possible option for their savings. Banks may also impose certain requirements or limits on withdrawals to maintain higher rates, making it essential for savers to understand the account's terms and conditions.

The primary appeal of high-yield savings accounts is the ability to earn competitive interest on deposits while maintaining liquidity. Unlike fixed-term investments or stocks, savers can access their funds relatively easily, providing a blend of growth potential and flexibility. As we dive deeper into the benefits, choosing the right account, and the associated processes, keep these foundational aspects in mind.

Benefits of High-Yield Savings Accounts

High-yield savings accounts come with a plethora of benefits that make them an attractive choice for managing personal finances. First and foremost, they generally provide higher interest rates compared to traditional savings accounts, which means your money can grow at a faster rate. For individuals looking to maximize the returns on their savings, this is a critical factor that should not be overlooked.

In addition to attractive interest rates, HYSAs often come with minimal fees and low minimum balance requirements. Many online banks charge no monthly maintenance fees, and some even have no minimum balance requirements, making them accessible for a broader range of consumers. This allows people to start saving with little upfront investment, making high-yield accounts a practical choice for those beginning their saving journey.

Furthermore, high-yield savings accounts offer a safe place to store money. They are typically insured by the FDIC up to applicable limits, which means that even in the unlikely event of a bank failure, your deposits are protected. Coupled with the flexible access to funds, the combination of safety and liquidity makes HYSAs one of the best options for short- to medium-term savings.

- Higher interest rates than traditional savings accounts

- Minimal fees and low minimum balance requirements

- FDIC insurance on deposits

Overall, high-yield savings accounts provide an excellent balance between earning potential and security, making them a preferred choice for many savers today. Rather than letting cash sit idle in low-interest accounts, individuals can take advantage of these features to enhance their financial growth strategies.

How to Choose the Best High-Yield Savings Account

Selecting the best high-yield savings account involves a careful comparison of different banks and their offerings. Start by looking at the interest rates; higher rates yield better returns. However, be cautious as some rates may be promotional and only temporary, so always check the duration of any promotional offers.

Next, consider the fees associated with the account. Look for accounts with low or no monthly maintenance fees, as these can significantly eat into your interest earnings. Also, check for any potential fees related to withdrawals or balance requirements, which could affect your ability to access your funds when needed.

Lastly, assess the financial institution's reputation and customer service. It’s essential to choose a bank that is not only offering competitive rates but also provides a reliable customer experience. Reading user reviews or checking ratings can provide insights into the institution's service quality and responsiveness.

- Compare interest rates across different institutions

- Evaluate associated fees and withdrawal limits

- Check reviews and ratings for customer service

By taking the time to carefully evaluate these factors, savers can make informed decisions that align their financial needs with the best offerings in the market, maximizing both savings potential and customer satisfaction.

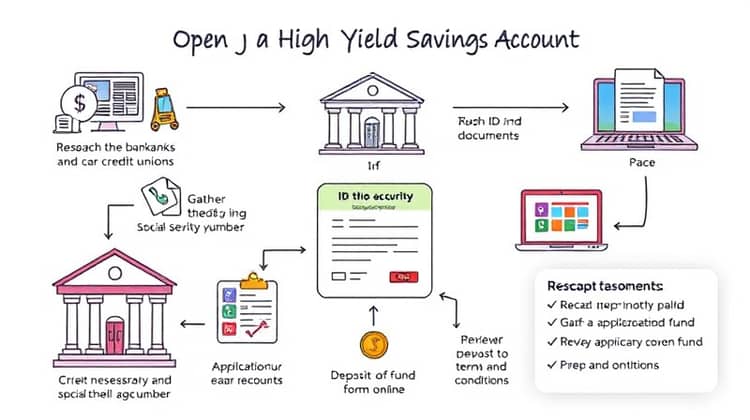

Steps to Open a High-Yield Savings Account

Opening a high-yield savings account can be a straightforward process if you follow the right steps. Begin with researching suitable banks or credit unions offering competitive rates and favorable account terms that align with your financial goals.

- Gather necessary documentation like identification and Social Security number.

- Fill out the application form either online or in-person as required.

- Fund your new account with an initial deposit, if there's a minimum requirement.

- Review the terms and conditions carefully before finalizing.

Once your account is set up, you can start enjoying the benefits of higher interest rates while keeping your funds secure and accessible.

Conclusion

In conclusion, high-yield savings accounts are an excellent way to increase your savings with minimal risk. They distinguish themselves from traditional accounts through their superior interest rates, lower fees, and ease of access to funds. Whether you are saving for an emergency fund, a vacation, or a large purchase, HYSAs can help you reach your goals more effectively than conventional savings options.

The growing popularity of these accounts reflects a broader shift towards seeking higher returns on savings. As financial literacy improves and consumers become more aware of the options available, high-yield savings accounts stand out not just for their yields but also for their safety and accessibility. They serve as an essential part of a well-rounded financial strategy, particularly in uncertain economic times.

When considering your savings strategies, remember the importance of evaluating various HYSAs to find one that meets your needs best. It can be beneficial to continuously monitor these accounts to ensure that you are getting the most competitive rates available, as financial institutions often adjust their offerings.

Ultimately, whether you're a seasoned saver or just beginning your financial journey, high-yield savings accounts can play a significant role in building wealth and achieving financial peace of mind. Taking advantage of the benefits they offer can help you create a more secure financial future.