In an ever-changing economic landscape, understanding how economic changes influence loan interest rates is crucial for consumers and lenders alike. Interest rates play a vital role in the financial sector, affecting everything from mortgage payments to business loans. As economies fluctuate, borrowers must stay informed about the factors that determine the cost of borrowing. This article will delve into the intricacies of interest rates, their workings, and how they are affected by various economic circumstances.

Interest rates can significantly impact an individual's or a business's financial health. A rise in interest rates can lead to higher monthly payments for loans, making them less affordable, while lower rates can stimulate borrowing and spending. This dynamic makes it essential for borrowers to be proactive and understand the mechanisms that govern interest rates and how to strategize their financial decisions accordingly.

Moreover, the intricacies surrounding interest rates extend beyond mere percentages; they reflect broader economic conditions, policy decisions, and market sentiments. Knowing what influences these rates can empower individuals and businesses to make informed financial choices, ultimately guiding them through a landscape that may seem daunting.

Interest Rate Defined

An interest rate is essentially the cost of borrowing money, expressed as a percentage of the principal amount, which is the initial sum of money borrowed. When individuals or businesses take out a loan, they agree to repay the borrowed amount along with interest over a predetermined period. This cost is what lenders charge for the use of their money, acting as compensation for the risk they take.

Interest rates can vary widely depending on the type of loan, the lender's policies, and the borrower's creditworthiness. For instance, a mortgage loan may have a different interest rate than a personal loan or a credit card debt. Lenders also consider market conditions, including inflation and the overall economic climate, when determining rates and terms.

In essence, interest rates serve as a critical mechanism that balances the needs of borrowers and lenders, influencing decisions in the housing market, personal finances, and larger economic growth.

How Interest Works

Interest can be calculated in various ways, with the most common methods being simple and compound interest. Simple interest is calculated only on the principal amount, while compound interest is calculated on the principal and any interest that has already been added to it. This distinction can significantly impact the total amount paid over the course of a loan, making it essential to understand these variations when reviewing loan agreements.

The frequency of compounding—whether daily, monthly, or annually—also affects how much interest accumulates over time. The more frequently interest is compounded, the more a borrower ends up paying. Understanding these concepts can help borrowers compare loan offers more effectively and choose the most advantageous terms for their financial situation.

Moreover, the timing of interest payments can also influence the total amount repaid. For example, some loans require interest to be paid upfront, while others allow for it to be added to the principal. Being aware of the terms can aid borrowers in managing their cash flow and financial planning.

Factors That Affect Interest Rates

Several key factors influence interest rates, impacting the broader market and individual borrowers alike. Generally, interest rates are closely tied to the central bank's monetary policy, inflation rates, and the overall state of the economy. When a central bank, like the Federal Reserve in the US, adjusts its rates, it can create ripple effects throughout the financial system, affecting everything from mortgage rates to savings accounts.

- Inflation: A rise in inflation typically leads to higher interest rates as lenders seek to maintain their profit margins.

- Economic Growth: During periods of economic growth, interest rates may increase due to higher demand for loans and increased spending.

- Central Bank Policies: Central banks influence interest rates through their monetary policies, increasing or decreasing rates based on economic conditions.

- Market Conditions: Global events, stock market trends, and overall economic uncertainties can also lead to fluctuations in interest rates.

By understanding these key factors, borrowers can better anticipate changes in interest rates and plan their financial decisions accordingly.

Different Types of Loans with Varying Interest Rates

Understanding the various types of loans available and their corresponding interest rates is vital for consumers. Loans can vary significantly based on their purposes and terms. While some loans may offer lower rates, others can come with higher rates due to their risk profiles and repayment structures.

- Mortgage Loans: These often have lower rates due to the long-term commitment and collateral attached to the property.

- Personal Loans: Interest rates can vary widely based on creditworthiness, but they generally have higher rates than mortgages.

- Credit Cards: These loans typically come with high-interest rates, especially for balances that are not paid in full each month.

- Auto Loans: These can have competitive rates, depending on factors like the value of the car and the borrower's credit history.

Being aware of the differences in loan types and their associated rates can help individuals choose the right financing options for their needs.

How the Economy Affects Interest Rates

The relationship between the economy and interest rates is profound and complex. Economic indicators such as GDP growth, unemployment rates, and inflation heavily influence how lenders set their interest rates. When the economy is thriving, and consumer demand is high, interest rates tend to rise as lenders anticipate greater competition for loans. Conversely, in a sluggish economy, rates may be lowered to encourage borrowing and stimulate economic activity.

Interest rates are also affected by unemployment levels; high unemployment may prompt central banks to lower rates to stimulate job creation by making borrowing cheaper for businesses. This interconnectedness illustrates how economic conditions dictate the available credit options for consumers and businesses alike.

Moreover, inflation affects purchasing power. When inflation increases, consumers' money loses value, prompting lenders to adjust their interest rates accordingly to maintain a stable return on their loans. Thus, understanding these economic factors can be key to making informed financial decisions.

What Are Fixed and Variable Interest Rates?

Interest rates can primarily be categorized into two types: fixed and variable (or adjustable) rates. Fixed interest rates remain constant throughout the life of a loan, providing borrowers with predictable monthly payments. This stability can be advantageous, particularly in uncertain market conditions where rates may rise uncontrollably.

On the other hand, variable interest rates can fluctuate depending on market conditions, often tied to an index. While these may start lower than fixed rates, they come with risks as they can increase over time. Borrowers who choose variable rates may benefit from lower initial payments but must be prepared for potential increases in repayment amounts as market rates change. Understanding the pros and cons of each type is crucial when selecting a loan based on individual financial goals and risk tolerance.

Financial crises, natural disasters, global pandemics

Financial crises have historically led to significant shifts in interest rates as governments and central banks step in to stabilize the economy. For example, the 2008 financial crisis prompted central banks worldwide to lower interest rates to unprecedented lows in an effort to encourage borrowing and investment during a period of economic uncertainty.

Natural disasters and global pandemics, like the COVID-19 outbreak, further complicate economic stability and have led to intervention from central banks. During such crises, emergency measures often include reducing interest rates, which can subsequently impact borrowing costs, economic growth, and consumer behavior.

In summary, understanding how crises influence interest rates emphasizes the importance of being adaptive and responsive to the ever-evolving economic landscape.

The Federal Reserve’s role in Interest Rates in the US

The Federal Reserve, or the Fed, plays a crucial role in setting interest rates in the United States. Through its monetary policy, the Fed can influence rates that banks charge one another for overnight loans, which in turn affects other interest rates across the economy, including those for personal, auto, and mortgage loans.

By raising or lowering the federal funds rate, the Fed can control inflation and stabilize the economy. For instance, during times of economic growth, the Fed may raise interest rates to curb inflation. Conversely, in recessionary periods, lowering rates can stimulate economic activity by encouraging borrowing.

In addition to adjusting rates, the Fed also conducts open market operations to manage the money supply, further influencing interest rates and the economy's overall direction. This vital role highlights the interconnectedness of federal policies, economic conditions, and consumer financial strategies.

Economic Conditions That Affect Interest Rates

Various economic conditions play a pivotal role in shaping interest rates. For instance, inflation, unemployment rates, and overall economic growth are significant indicators that lenders consider when setting rates. High inflation typically leads to increased rates as lenders need to compensate for the decrease in purchasing power of money over time.

Additionally, geopolitical issues or global economic shifts can impact local interest rates, underscoring the importance of being vigilant about international developments and their potential influence on domestic economic conditions.

- Inflation trends

- Unemployment statistics

- Global economic shifts

- Central bank policies

Recognizing these factors can empower consumers to make informed decisions regarding their borrowing and financial planning.

What Happens During a Recession?

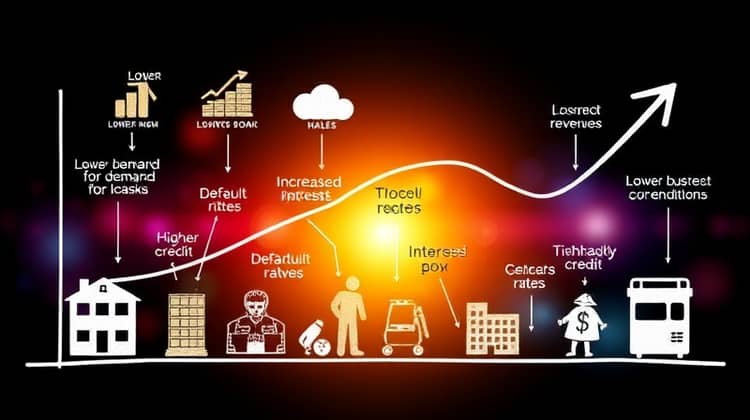

During a recession, economic activity slows, leading to a decrease in demand for loans and increased default risks. In response, lenders often reduce interest rates to encourage borrowing and stimulate the economy. Lower rates are generally aimed at making loans more accessible and affordable to individuals and businesses.

Additionally, a recession typically results in higher unemployment rates, which further impacts consumer spending and economic growth. As businesses face lower revenues, lending becomes more conservative, leading to tighter credit conditions.

In these times, consumers may find it more challenging to qualify for loans, as lenders adjust their criteria to mitigate risks. Understanding these changes can help borrowers navigate financial decisions amidst economic downturns, ensuring they make savvy choices during turbulent times.

Recessions, while challenging, can also present opportunities for those who are prepared to seize favorable loan terms as interest rates decline in efforts to stimulate economic recovery.

Future Predictions for Interest Rates

Looking to the future, predictions about interest rates depend heavily on broader economic indicators and central bank policies. Analysts often rely on trends in inflation, employment rates, and global economic conditions to provide forecasts regarding potential interest rate movements. As economies recover from downturns or shifts in economic policy are implemented, interest rates may either rise or fall accordingly.

Additionally, the influence of technology and evolving markets may lead to more competitive rates, especially as consumers have access to more information and options. By paying close attention to these factors, borrowers can position themselves favorably for future financial decisions.

What the Past has Shown Us

Historical analysis of interest rates reveals that they often react to economic cycles and significant events, such as recessions and financial crises. When looking back, we see that periods of economic expansion typically lead to higher rates as consumer demand increases, while downturns inspire lower rates to foster growth and recovery.

Moreover, historical trends show the impact of monetary policy on interest rates, providing necessary insights for understanding future movements. By studying how past events shaped rate changes, borrowers can gain valuable knowledge that informs their financial planning and decision-making.

To Sum It All Up:

Understanding the interplay between economic changes and loan interest rates is of paramount importance for consumers and businesses alike. Borrowers must stay informed about the factors affecting rates, including inflation, economic growth, and central bank policies, to make sound financial decisions.

Additionally, recognizing the different types of loans available and their interest rate configurations can help consumers choose the best options tailored to their needs. Whether opting for fixed or variable rates, each choice comes with its considerations that can significantly impact overall financial health.

Moreover, being aware of historical trends and forecasts can empower individuals to navigate the complexities of borrowing in any economic climate. With careful planning and an informed approach, borrowers can better manage their financial futures, even amid uncertainty in the economy.

In conclusion, the relationship between economic changes and loan interest rates highlights the paramount importance of financial literacy for consumers. By educating themselves and preparing for fluctuations, borrowers can make more strategic decisions that will benefit them in the long run.