Investing can be a daunting task, especially when markets are volatile and you're unsure of when to buy. One popular strategy that helps mitigate the stress of timing the market is dollar-cost averaging (DCA). This approach simplifies the investment process and can lead to better long-term financial outcomes.

In this article, we'll explore what dollar-cost averaging is, how it works, its benefits and limitations, and whether it's the right strategy for you.

What Is Dollar-Cost Averaging?

Dollar-cost averaging is an investment strategy where an investor regularly invests a fixed amount of money into a particular asset over time, regardless of its price fluctuations. By consistently buying into the asset at regular intervals, the investor effectively smooths out the purchase price over time.

This strategy can help reduce the impact of volatility and mitigate the risk of making poor investment decisions based on market timing. It aligns with the philosophy of investing for the long term rather than trying to predict short-term market movements.

- Regular investment schedule (monthly, quarterly)

- Fixed investment amount each time

- Application to various asset classes (stocks, mutual funds, ETFs)

Dollar-cost averaging can be a particularly useful strategy for novice investors or those who may get overwhelmed by market movements, as it encourages disciplined investing.

How It Works

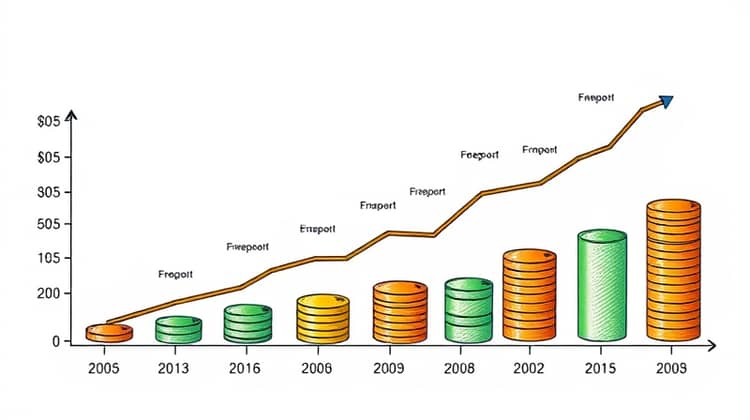

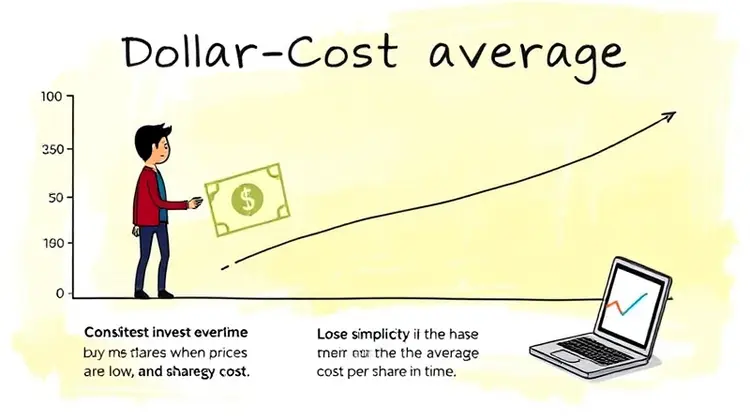

Dollar-cost averaging works by dividing the total investment amount into equal parts invested across specific periods. For instance, if you plan to invest $12,000 in a particular investment, you might choose to invest $1,000 every month for a year. This method allows you to buy more shares when prices are low and fewer shares when prices are high.

The beauty of this strategy lies in its simplicity. You don’t have to worry about trying to time the market and guess when the best moment to buy is; you just stick to your plan and invest consistently. Over time, your average cost per share becomes lower compared to making a lump-sum investment at a potentially inopportune time.

Additionally, many brokerage platforms allow for automated investments, which can help you stick to this plan without needing to monitor the market constantly.

Benefits

There are several advantages to using dollar-cost averaging as an investment strategy. One key benefit is its ability to reduce the emotional stress that often accompanies investing. By committing to a fixed investment amount regularly, investors can avoid panic selling during market downturns or feeling overwhelmed during market highs.

Furthermore, dollar-cost averaging encourages a long-term investment mindset. It helps cultivate the habit of saving and investing regularly, irrespective of market conditions. This discipline can lead to considerable wealth accumulation over time.

- Reduces emotional investment decisions

- Results in an average cost per share over time

- Encourages disciplined saving and investing

Overall, the benefits of dollar-cost averaging make it an appealing strategy for many investors, particularly those new to the investment world.

Limitations

While dollar-cost averaging has numerous advantages, it also has some limitations that investors should consider. One major limitation is that it may result in lower returns in a consistently rising market. If an investor chooses to dollar-cost average during a bull market, they might end up paying more over time compared to a lump-sum investment made at the outset.

- Potentially lower returns in a rising market

- Does not guarantee profits

- Doesn't protect against market downturns

Despite these limitations, many investors find that the benefits of dollar-cost averaging outweigh the drawbacks, especially in uncertain market conditions.

Is Dollar-Cost Averaging Right for You?

Deciding whether dollar-cost averaging is the right strategy for you largely depends on your investment goals, risk tolerance, and financial situation. If you prefer a method that promotes consistent investing without the stress of market timing, DCA could be suitable for your portfolio.

It's important to evaluate your comfort with regular investments and whether you have the ability to commit to a long-term strategy. If you believe in the market's overall upward trajectory and are ready to invest regularly, dollar-cost averaging might be an excellent fit.

- Evaluate your financial goals

- Assess your risk tolerance

- Consider your investment timeline

Taking the time to analyze these factors can help you determine if dollar-cost averaging aligns with your overall investment strategy.

Conclusion

In conclusion, dollar-cost averaging is a valuable investment strategy that can help investors build wealth over time while mitigating the stress of market volatility. It encourages disciplined investing and can be particularly beneficial for those new to investing or those without the time to actively manage their portfolios.

However, it's essential to be aware of its limitations and assess whether this approach aligns with your specific financial circumstances and goals. By understanding both the benefits and drawbacks, you can make an informed decision about whether dollar-cost averaging is right for you.