Loan rejections can feel disheartening, especially when you need financing for a crucial purpose. However, being denied a loan doesn’t have to be the end of the road. Instead, it presents an opportunity to reassess your financial standing and improve your eligibility for future loan applications.

The steps outlined below will guide you in understanding the reasons behind the rejection and what you can do to enhance your chances of securing a loan in the future. By taking proactive measures, you can move towards your financial goals with greater confidence.

Understand Why You Were Denied

Understanding the reasons behind a loan denial is the first step towards rectifying the situation. Loan denials can occur due to various factors and examining these reasons closely can help you prepare your next application more effectively.

- Insufficient income to support loan repayment

- Poor credit history or credit score

- High debt-to-income ratio

- Incomplete loan application or missing documentation

- Changes in employment status or job instability

Once you comprehend the underlying issue, you can take targeted actions to address it. Identifying the specific cause will empower you to focus on the areas needing improvement.

Check Your Credit Report

Your credit report provides a comprehensive view of your credit history and is crucial in the lending process. Regularly checking your credit report can help you discover any inaccuracies that could have led to your loan denial.

- Request a free copy of your credit report from authorized agencies

- Review the report for any errors or discrepancies

- Dispute any inaccuracies with the credit bureau immediately

- Monitor your credit report regularly to stay updated

Addressing the inaccuracies on your credit report can often lead to an immediate improvement in your credit score, making you a more attractive candidate for lenders.

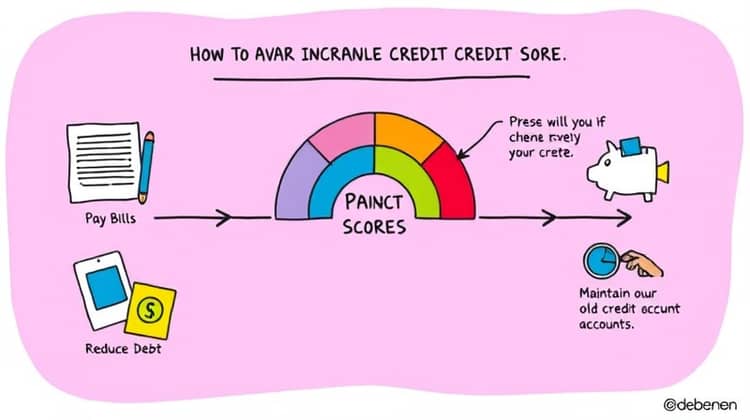

Improve Your Credit Score

Improving your credit score is vital in increasing your chances of loan approval. A strong credit score indicates to lenders that you are a responsible borrower who is likely to repay the loan on time.

There are several strategies you can employ to elevate your credit score over time. Staying disciplined in your financial habits will have a positive effect on your creditworthiness.

- Pay your bills on time to avoid late fees and negative impact on your credit score

- Reduce outstanding debts to improve your credit utilization ratio

- Avoid opening new credit accounts unnecessarily

- Keep old credit accounts open to maintain a longer credit history

- Limit hard inquiries into your credit report

By taking these steps, you will cultivate a stronger credit profile. Remember, improving your credit score won’t happen overnight, but consistent effort will show results in the long run.

Consider Changing Your Loan Application

If your loan application was denied due to specific criteria not being met, consider adjusting your application before reapplying. A few changes can make a significant difference in how lenders perceive your request.

- Adjusting the loan amount you are requesting

- Improving your financial documentation to include additional income or assets

- Opting for a co-signer to strengthen your application

- Exploring different types of loans that may suit your financial situation better

These alterations can make you a more appealing candidate, and you'll find lenders more willing to work with you.

Explore Different Lenders

Different lenders have varied requirements and criteria for approving loans. Exploring multiple lending options can expose you to more favorable conditions and possibilities.

- Local banks and credit unions may offer personalized service and lower rates

- Online lenders often provide faster approvals and flexible options

- Peer-to-peer lending platforms can be an alternative to traditional lenders

- Specialized lenders might have loans tailored to specific needs

Researching and comparing different lenders will empower you to find the right fit for your financial circumstances.

Seek Professional Advice

Consulting with a financial advisor or loan specialist can be incredibly beneficial for individuals who face challenges in securing a loan. These professionals can provide targeted advice tailored to your unique situation.

- Financial advisors can help you create personalized plans to improve financial health

- Credit counselors can assist with strategies to manage debt and improve credit scores

- Loan specialists can guide you in selecting the right lenders and loan types

With professional guidance, you can navigate the complexities of loan applications with increased confidence and potentially better outcomes.

Reapply When You’re Ready

Once you have taken the necessary steps to improve your financial situation, it’s time to prepare to reapply for a loan. Ensure that you feel adequately prepared and informed before submitting your application.

A well-prepared application will reflect the changes you have made and demonstrate your commitment to responsible borrowing.

- Collect all necessary documentation in advance

- Double-check your application for completeness and accuracy

- Be specific about the loan amount and purpose

Timing your reapplication wisely, based on improvements made, can lead to a successful loan approval this time around.

Final Thoughts

Experiencing a loan denial can be disheartening, but it’s essential to view it as a learning opportunity. By understanding the factors that contributed to the denial, you can take constructive steps to improve your financial profile and increase your chances of a successful application in the future.

Building and maintaining good credit is a marathon, not a sprint. It requires discipline, time, and responsible financial behavior to achieve lasting results.