Debt can feel overwhelming, and for many individuals, managing multiple debts can lead to confusion and stress. When bills pile up from various sources, such as credit cards, personal loans, or medical expenses, it’s understandable that finding a streamlined solution becomes a priority. One popular option that people often consider is a debt consolidation loan.

Debt consolidation loans can help simplify the repayment process by combining several debts into one single loan with a potentially lower interest rate. However, before choosing this route, it’s critical to weigh the benefits and drawbacks carefully. In this article, we will explore what debt consolidation loans are, their benefits, potential downsides, and how to decide if they are the right choice for your financial situation.

Understanding Debt Consolidation Loans

Debt consolidation loans are financial products designed to help individuals consolidate multiple debts into a single loan. This approach can potentially simplify making monthly payments by unifying various debts into one manageable payment, often at a lower interest rate than the combined rates of the individual debts.

These loans can be secured, meaning they require collateral (such as a home or vehicle), or unsecured, which does not require any collateral. The choice between these types depends on the borrower’s credit profile and their willingness to risk assets for better loan terms.

- Combine multiple debts into a single monthly payment

- Potentially lower your overall interest rate

- Simplify your budgeting process

- Improve your credit score over time through consistent payments

- Provide a clear repayment timeline

However, it's essential to note that simply having a debt consolidation loan doesn’t mean you will be free of debt forever. Responsible financial planning and management are crucial in preventing the accumulation of additional debts after consolidation.

Benefits of Debt Consolidation Loans

One of the most significant advantages of debt consolidation loans is that they can reduce the stress of managing multiple payments by streamlining everything into a single monthly payment. This can help you stay organized and ensure timely payments, reducing the risk of late fees and negative impacts on your credit score.

Additionally, lower interest rates can lead to long-term savings. By consolidating high-interest debts, such as credit cards, at a lower interest rate, you can significantly lower the total amount paid over time.

- Consolidation leads to a clearer financial plan

- Potential for reduced interest rates

- Easier to manage payments and avoid missed deadlines

- May allow for increased cash flow in the short term

- Improvement in credit score if managed prudently

While the advantages can be appealing, it’s crucial to keep in mind the overall financial discipline required to make this strategy work effectively.

Potential Drawbacks

Although debt consolidation loans can be beneficial, they come with some potential drawbacks. First, if you’re unable to keep up with the loan payments after consolidation, this could worsen your financial situation. Additionally, extending the loan term may lead to paying more in interest over time despite the lower monthly payments.

- May incur fees that add to your total debt

- Potential for higher overall interest if extended too long

- Risk of accumulating new debts if spending habits don't change

- Credit score impact if payments are missed

These drawbacks highlight the importance of assessing your financial habits and discipline before proceeding with any debt consolidation strategy.

How to Determine if a Debt Consolidation Loan is Right for You

Determining if a debt consolidation loan is suitable for you requires careful consideration of your current financial situation. Start by analyzing your outstanding debts, their interest rates, and your payment capacity. It's crucial to understand whether a debt consolidation loan will genuinely alleviate financial stress and improve your debt repayment terms.

Consider your overall financial goals and whether consolidating your debt aligns with them. A realistic assessment of your spending habits and income stability is also vital.

- Assess your total debt load and monthly payments

- Determine the interest rates on your current debts

- Evaluate your credit score and loan eligibility

- Consider your spending habits

Taking these steps will help you gain clarity on whether debt consolidation is a strategic move or if there might be more effective alternatives to explore.

Steps to Take if You Decide to Pursue a Debt Consolidation Loan

If you've decided that a debt consolidation loan is the right option for you, there are several steps you should follow to ensure a smooth process. First, research various lenders and the different types of loans they offer. Compare interest rates, terms, and any fees associated with the loans to find the best fit for your needs.

Next, gather all necessary financial documents, including proof of income, credit history, and a breakdown of your existing debts. This information will be crucial in assessing your loan eligibility and terms.

- Research various lenders and loan options

- Collect financial documents and debt information

- Understand the terms and conditions of the loan

- Prepare to demonstrate your income and repayment ability

Completing these steps will equip you with the necessary knowledge and resources to make an informed decision when opting for a debt consolidation loan.

Tips for Managing Your Newly Consolidated Debt

Once you've consolidated your debt, proper management becomes essential to ensure financial stability moving forward. Establish a strict monthly budget that allocates funds not only for loan repayment but also for essential living expenses and savings.

Avoid the temptation to accumulate more debt, which can quickly undo the benefits of consolidation.

- Create a regular budget plan

- Prioritize paying off the consolidated loan

- Limit the use of credit cards

- Track all spending and savings regularly

Implementation of these strategies will assist you in maintaining financial discipline and enjoying the advantages of your consolidated loan.

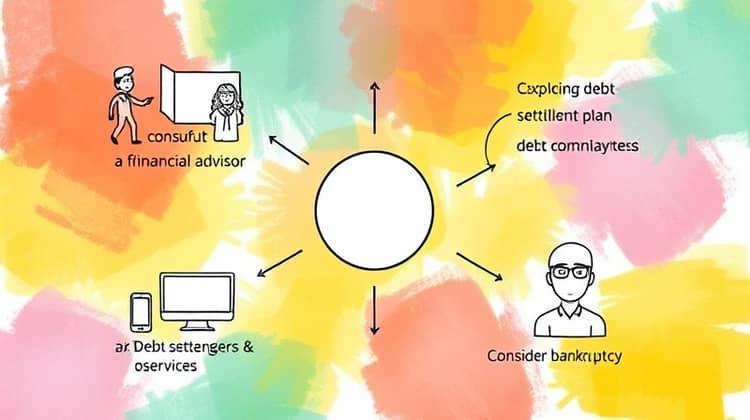

Alternative Options to Consider

If debt consolidation loans do not seem viable for your situation, consider exploring alternative options. Debt settlement, credit counseling, or bankruptcy might be more appropriate, depending on your financial circumstances.

Each alternative has its pros and cons, so understanding your overall financial situation and consulting with a financial advisor might be beneficial.

- Seek professional financial counseling

- Consider a debt management plan

- Explore debt settlement services

- Evaluate bankruptcy options

Understanding these alternatives will provide a more comprehensive view of the options available in managing your debt effectively.

Conclusion

In conclusion, debt consolidation loans can be a helpful solution for managing debt effectively when used properly. By carefully evaluating your financial situation, and understanding both the benefits and potential downsides, you can make an informed decision that aligns with your financial goals.

Always remember that responsible financial management and planning are essential components in achieving long-term success in debt repayment and financial stability.