Managing credit card debt is a vital aspect of personal finance, and understanding payment options can significantly influence your financial health. With options such as paying in full or making minimum payments, consumers can navigate their debt more effectively in ways that align with their financial capacity and goals.

This article will explore these options, weigh their pros and cons, and provide insights on balance transfers, ultimately helping you decide which payment method is best for your financial situation.

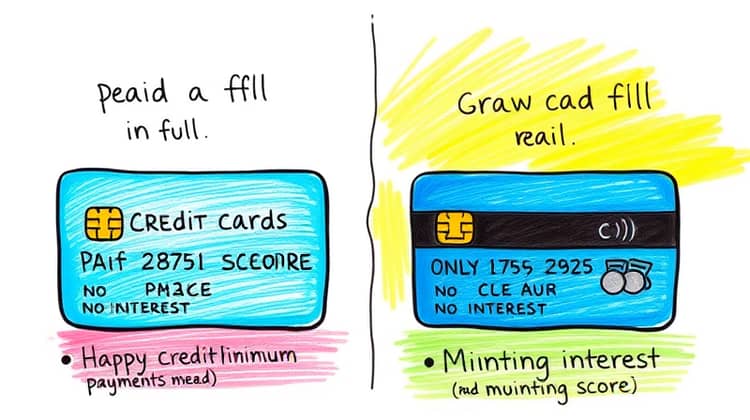

Payment in Full vs. Minimum Payment

When using a credit card, one of the first decisions you face is whether to pay off the balance in full or to make the minimum payment. Paying in full means settling your entire balance by the due date, whereas making the minimum payment allows you to pay just a fraction of what you owe, with the option to carry the remainder into the next billing cycle.

- Paying in full helps you avoid interest charges.

- It maintains a good credit score by keeping your utilization low.

- A minimum payment can aid cash flow in the short term, but it increases long-term costs.

- Minimum payments can lead to debt accumulation by generating ongoing interest.

Each of these options carries its own set of implications that can either bolster or diminish your overall financial health. Understanding these aspects is crucial when deciding how to manage your credit card payments.

Pros and Cons of Each Method

As with most financial decisions, there are advantages and disadvantages to both payment methods. Knowing the benefits and potential drawbacks can help you make informed choices that align with your financial strategy.

Paying in Full

Paying your credit card balance in full is generally regarded as the best practice for managing your finances. It allows you to avoid accruing interest on your purchases and keeps your debt at bay.

- Saves money on interest charges.

- Improves and maintains a great credit score.

- Provides peace of mind knowing debts are settled promptly.

- Allows for better budgeting and financial planning.

Ultimately, paying in full could be the most financially advantageous choice, especially for those who are disciplined about their spending and budgeting.

Minimum Payment

Minimum payments, on the other hand, can be a tempting option for those facing temporary financial challenges. They provide immediate relief in cash flow, allowing you to retain more cash during a tough month.

However, relying on minimum payments can be risky; as debt continues to grow due to interest rates applied to the remaining balance, it can lead to a cycle of debt that's hard to break.

- Offers immediate cash flow relief.

- Allows consumers to keep more of their money during financial struggles.

- May lead to greater long-term financial costs due to accruing interest.

- Potential risk of increasing debt if not managed carefully.

- Can negatively impact credit utilization ratios.

It is crucial to weigh these factors before deciding to consistently make only minimum payments, balancing immediate needs against long-term financial health.

Balance Transfers

Another consideration in managing credit card debt is the option of balance transfers. These can be an effective strategy for consolidating debt, particularly when transferring higher interest rates to a card with lower or promotional rates.

However, while balance transfers can save money on interest in the short-term, they also come with fees that may negate some of those savings, as well as the risk of accumulating new charges on the card if not monitored closely.

Conclusion

In conclusion, both paying in full and making minimum payments have their unique benefits and drawbacks. Choosing the best option depends on your financial situation, including cash flow, credit goals, and overall debt management strategy. Ultimately, being informed and adopting a disciplined approach to credit card payments can pave the path to healthier financial outcomes.