In the world of real estate, construction loans can be the key to unlocking your vision of building the perfect home or commercial space. They provide the necessary funding to cover the costs associated with construction projects, helping to convert blueprints into reality. Whether you're a first-time builder or an experienced developer, understanding construction loans is crucial to successfully managing your building project.

These loans come with specific terms and can be tailored to fit various project needs, from new constructions to renovations. However, they can also seem complex, making it essential to familiarize yourself with the different types available and how they operate. Let's dive into the details and explore each aspect of construction loans so you can make informed decisions.

From eligibility requirements to the application process and loan management strategies, this article will cover all you need to know to secure the funding needed for your construction endeavors. Join us on this journey of discovery as we dissect construction loans and their implications for your building project.

Understanding Construction Loans

Construction loans are short-term financing solutions specifically designed to cover the costs of a construction project. Unlike traditional mortgages, which provide long-term financing for purchasing a completed home, construction loans are typically disbursed in stages to facilitate the build process. This allows the borrower to only pay interest on the amount drawn as the project progresses.

The financing can cover various aspects of the construction project, such as land acquisition, materials, labor, and permits. It is essential to note that these loans often have a higher interest rate compared to standard mortgages due to the increased risk lenders undertake when financing a project that is yet to be completed.

Construction loans usually require a higher level of documentation than standard loans. Lenders often ask for detailed plans, budgets, and timelines to gauge the feasibility of the project and ensure that it stays on track. By understanding these components, builders can significantly improve their chances of securing funding.

Types of Construction Loans

There are several types of construction loans available to meet various financing needs of builders and developers. Each type serves a unique purpose and comes with its terms, ultimately affecting how repayment is structured and funds are disbursed.

Understanding the differences among them is crucial to choosing the right financing option for your project. Here, we explore the three main types of construction loans:

1. Construction-to-Permanent Loan

A Construction-to-Permanent Loan provides financing for both construction and the permanent mortgage. This type of loan eliminates the need for multiple loans, saving time and money in the process.

- Single application process: Only one application required for both construction and permanent mortgage.

- Fixed or adjustable rates available: Borrowers can choose between fixed and adjustable rates once the construction phase is complete.

- Streamlined transition: The loan seamlessly converts from a construction loan to a permanent mortgage upon project completion.

This convenience allows borrowers to focus on their project without having to navigate multiple lenders or financing options.

2. Stand-Alone Construction Loan

A Stand-Alone Construction Loan is a short-term loan specifically for funding the construction phase of a project. This loan is paid off once the construction is completed and typically requires the borrower to refinance into a permanent loan afterward.

This option may appeal to borrowers who prefer flexibility or expect an increase in property value upon completion. However, it might also require additional fees and time to secure a permanent mortgage.

3. Renovation Construction Loan

A Renovation Construction Loan is targeted towards homeowners looking to finance improvements or upgrades to an existing property. This can include major renovations or smaller projects that add value to a home.

These loans provide the necessary capital for both the purchase of the property and the cost of renovations. They are often available through standard mortgage lenders, making them accessible for many homeowners.

- Financing for home improvement projects: Cover significant renovations or upgrades.

- Combined mortgage and renovation costs: Streamlined financing option that helps increase property value.

- Flexible repayment terms: Offers various options to meet different financial needs.

This type of loan can be especially beneficial for buyers looking to purchase a fixer-upper property, offering them the funds needed to make the necessary improvements.

How Construction Loans Work

Construction loans are typically structured as interest-only loans during the construction period, allowing borrowers to pay only the interest on the amount drawn rather than the full principal. These loans have set terms, generally lasting between six months to a few years, depending on the project timeline.

The lender disburses funds in increments, known as "draws," based on project milestones. The borrower will have to submit requests for payment as construction progresses, and the lender may require inspections before approving each draw. This ensures that funds are allocated appropriately and minimizes risk for the lender.

- Borrowers submit an application with project details to the lender.

- Upon loan approval, funds are advanced in stages based on completed work.

- Borrowers make interest-only payments during the construction phase.

- Once completed, the loan transitions into a permanent mortgage (if applicable).

Overall, understanding the mechanics of how construction loans work enhances a builder's ability to effectively manage their project and funding.

Eligibility and Requirements

Lenders require specific documentation and qualifications for construction loans, typically involving higher scrutiny than traditional mortgages. Some common criteria include a detailed construction plan, budget, timeline, and creditworthiness of the borrower.

Borrowers should prepare to present their financial history, including income, employment documentation, and an outline of assets and liabilities. A solid credit score will enhance the likelihood of securing a favorable loan.

In some cases, lenders might also require experience in construction or real estate development to assure that the borrower can responsibly manage the project's financial aspects. Potential borrowers should consider consulting a financial advisor to gauge their eligibility effectively.

- Detailed construction plans and specifications.

- Personal financial documentation (income, assets).

- Creditworthiness assessment (credit score and history).

Meeting these requirements can significantly enhance the chances of obtaining a construction loan.

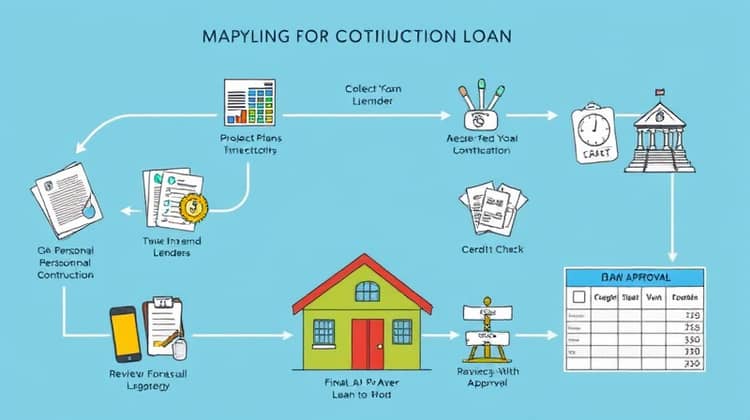

The Application Process

When applying for a construction loan, prospective borrowers should be prepared for a comprehensive application process that requires gathering extensive documentation. This includes project plans, budgets, timelines, and personal financial information.

After submission, lenders will review the application, conduct a credit check, and possibly request additional documentation or clarifications regarding the project.

Once the application is approved, borrowers receive a Loan Estimate, detailing terms and conditions, expected monthly payments, and closing costs.

- Gather all necessary documentation for the application.

- Submit application to the lender for review.

- Wait for the lender's decision and Loan Estimate.

Having everything organized can facilitate a smoother application process and potentially lead to better financing terms.

Managing Your Construction Loan

Managing a construction loan involves active oversight of the disbursement process and the project execution. Builders must keep track of cash flow, ensuring that funds are drawn appropriately to finance tasks without running into delays.

Regular communication with the lender is also crucial, as timely payments and updates can help prevent issues down the road. Proper record-keeping and accounting for all expenditures will benefit the project's financial integrity.

- Maintain open communication with your lender.

- Track project expenses and draw requests.

- Ensure timely completion of milestones for funding disbursement.

Effective management throughout the construction process can help avoid pitfalls and ensure that the project meets its financial goals.

Pros and Cons of Construction Loans

Like any financial product, construction loans have their advantages and disadvantages. Understanding these can help borrowers make informed decisions when financing their building projects.

Pros:

Some key benefits of construction loans include:

- Customized loan amounts to fit specific project needs.

- Funding released over time to match project progression.

- Applicability for new builds and extensive renovations.

These advantages can make construction loans an attractive option for those involved in building projects.

Cons:

However, there are also some challenges associated with construction loans, such as:

- Higher interest rates compared to traditional mortgage loans.

- Increased documentation and disclosure requirements.

- Higher levels of scrutiny during the loan application process.

Awareness of these cons is essential for potential borrowers to navigate the financial landscape effectively.

Alternatives to Construction Loans

While construction loans provide specific funding solutions, there are alternative financing options available, depending on your project's needs. These may work better for some individuals based on their situation.

- Home equity loans or lines of credit.

- Personal loans for smaller renovation projects.

- Government grants and programs for home improvements.

Researching these alternatives can open new pathways to funding your building project while potentially alleviating financial burdens.

Conclusion

In summary, construction loans can be a valuable asset in financing a building project, providing essential funds to ensure successful completion. Understanding the terms, types, and processes involved can help borrowers make the right choices for their specific needs.

As with any financial commitment, careful consideration and planning are crucial to navigate the complexities of construction financing effectively. By weighing options, understanding obligations, and keeping communication open with lenders, builders can turn their visions into successful reality.