When it comes to managing your finances, understanding the impact of closing a credit card account on your credit score is crucial. Many people may not realize that this decision can have significant and lasting effects on their overall credit profile. In this blog post, we will explore various aspects of credit scoring and how closing a credit card fits into that picture.

We'll delve into factors like the length of credit history, credit utilization ratio, and alternative strategies that can help you maintain a healthy credit score. The goal is to equip you with the knowledge you need to make informed decisions regarding your credit accounts, minimizing any negative impacts to your creditworthiness.

By the end of this article, you will have a clear understanding of how closing a credit card account affects your financial future, and the steps you can take to navigate this process wisely.

How Closing a Credit Card Affects Your Credit Score

When you close a credit card account, it can lead to immediate changes in your credit score, which raises considerable concern for many consumers. Among these changes, two key factors come into play: your credit utilization ratio and the length of your credit history. Both of these elements are critical in determining your overall creditworthiness and can be affected by the simple act of closing an account.

One common misconception is that closing an unused credit card will automatically improve your credit score by eliminating potential debt. However, this approach often backfires, leading to an increase in your credit utilization ratio—a relationship between your total credit available and the amount of credit you actively use. The key is to find a balance that works for your financial situation and credit score.

Moreover, closing a credit card affects your credit history negatively, particularly if it was one of your older accounts. The length of your credit history makes up a significant portion of your score. Hence, the longer you maintain your accounts, the better your credit score may become.

Length of Credit History

Credit history length is a vital component of your credit score, responsible for approximately 15% of the FICO score calculation. When you close an older credit card account, you effectively shorten the average age of your credit accounts. This can lead to a decline in your score, as lenders prefer to see a well-established history of responsible credit management.

It's important to keep in mind that while the closed account will remain on your credit report for up to ten years, its impact on your score diminishes over time. However, during that period, lenders will still see the credit account's closure, potentially affecting their perception of your creditworthiness.

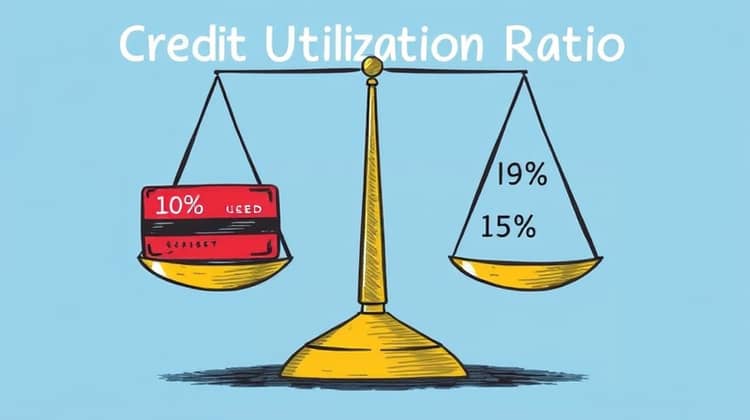

Credit Utilization Ratio

The credit utilization ratio is another crucial factor influencing your credit score, making up about 30% of the FICO score calculation. This ratio measures the amount of credit you're using in relation to the total credit available to you. When you close a credit card, you reduce your total available credit, which can significantly increase your utilization percentage if you carry balances on other accounts.

For instance, if you have a total credit limit of $10,000 and you owe $3,000, your credit utilization ratio is 30%. But if you close a card with a $5,000 limit, your total credit limit drops to $5,000, resulting in a utilization rate of 60%. A higher utilization ratio can be seen as a sign of financial distress, leading to a lower credit score.

Changing Strategies

As you consider the implications of closing a credit card on your credit score, it's also worth exploring strategies that may help mitigate the potential negative effects. One way to change your approach is to learn how to manage your accounts effectively, ensuring that you maintain a healthy balance across your credit lines without overextending yourself. This can include a range of tactics that keep your credit score in good standing without needing to close accounts.

Additionally, keeping older accounts open can work in your favor, even if they’re not frequently used. Many people don’t realize that having a mix of open accounts—such as a mix of credit card accounts, installment loans, or other credit types—can be beneficial to your score. It can be advantageous to maintain older credit accounts, as they contribute positively to the length of your credit history.

- Consider reducing your overall spending on credit cards before closing an account.

- Evaluate whether the annual fee or other costs outweigh the benefits of keeping an unused card.

- Monitor your credit utilization ratio as you make changes to your accounts.

- Keep track of your payment history and avoid missing payments on your other accounts.

Incorporating these strategies allows you to make informed decisions when it comes to managing your credit, minimizing potential pitfalls that may arise from closing credit accounts. By maintaining a rigorous approach to your debt management, you can ensure that you’re not unintentionally harming your credit score while pursuing your financial goals.

Ultimately, understanding the nuances of your credit score empowers you to make the best decisions for your financial health. It’s critical to approach every decision, particularly those involving credit, with a clear picture of how the choices you make will affect not just your number today, but your ability to achieve larger financial objectives in the future.

Alternatives to Closing a Credit Card

Before deciding to close a credit card account, explore alternatives that can help you maintain a healthy credit score while addressing the reasons you might be considering closing the card. Keeping accounts open, even if they are seldom used, provides a safeguard for your credit profile.

Another alternative involves contacting your credit card issuer to discuss your concerns. In some cases, they may offer options such as reducing your credit limit or waiving annual fees that make it easier to maintain the account without incurring high costs.

- Keep the card and use it for small, essential purchases to keep it active.

- Request a credit limit decrease instead of closing the account entirely.

- Look for other credit cards with no annual fees to minimize costs without losing available credit.

- Set reminders to use the card at least once every six months to keep it active.

These alternatives not only preserve your credit score but also strengthen your financial management skills. By keeping a careful watch on your credit accounts, utilizing them wisely, and communicating with your lenders, you can avoid knee-jerk reactions that may lead to closing accounts unnecessarily.

In addition, being proactive about your financial health can foster better relationships with lenders and create more favorable borrowing terms for you in the future.

Conclusion

Understanding the complexity surrounding credit cards and your credit score is vital to managing your financial future. Closing a credit card account can seem like a harmless decision, yet its repercussions can echo through your credit history for years. Taking proactive steps can be just as important as any single action.

To summarize, remember to evaluate the potential impacts on your credit utilization ratio and length of credit history before closing any accounts. Keeping accounts active may seem counter-intuitive, but maintaining a diverse lineup of credit options can solidify your financial standing and allow for better financial opportunities in the future.

Ultimately, the most prudent course of action is to weigh your options, consider the long-term repercussions, and keep your goal of maintaining a healthy credit score at the forefront of your decision-making process.