Choosing the right bank account is a crucial decision that can impact your financial health. With a myriad of options available, it can sometimes feel overwhelming to determine which account best suits your needs. Whether you are setting up your first bank account or are considering switching to a new one, there are several factors to take into account that can help you make an informed decision.

This article outlines five key factors to consider when choosing a bank account: account fees, interest rates, accessibility and convenience, security features, and additional services. Taking the time to evaluate these factors will not only save you from hidden costs but will also align your banking choice with your financial goals.

Understanding these components can assist in finding an account that not only meets your expectations but enhances your banking experience. Let’s delve into each of these factors to ensure you have all the information necessary for making the best decision for your financial future.

1. Account Fees

One of the first things to consider when opening a bank account is the associated fees. Different banks have different fee structures, and it's essential to understand these costs to avoid unexpected charges that could diminish your savings.

- Monthly maintenance fees

- ATM withdrawal fees

- Overdraft charges

- Account closure fees

- Foreign transaction fees

By thoroughly understanding the account fees and evaluating which costs you are willing to manage, you can choose a bank account that aligns with your budget and financial needs.

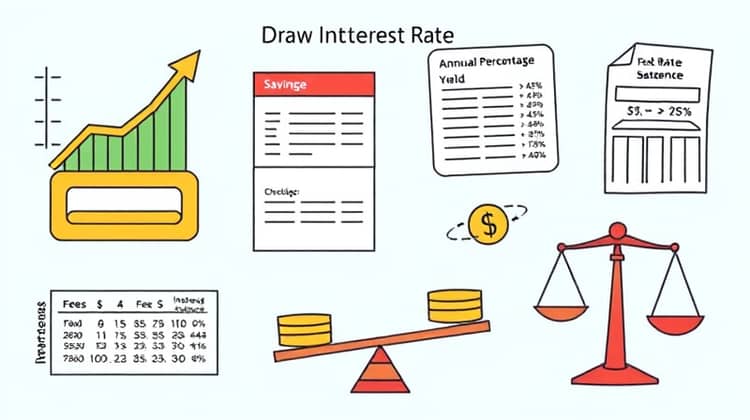

2. Interest Rates

Interest rates are another vital component of banking services. They can significantly impact how much you earn on savings accounts or how much you pay on loans. Therefore, it’s essential to compare the interest rates offered by various banks before making your choice.

- Annual Percentage Yield (APY) on savings accounts

- Interest rates on checking accounts

- Fees for withdrawing or closing accounts that may affect earnings

- Comparison of introductory rates vs. standard rates

- Rate caps and triggers for interest on different account balances

Securing a higher interest rate can help you maximize your savings, so it is beneficial to explore options such as high-yield savings accounts if your primary goal is earning interest.

3. Accessibility and Convenience

Accessibility to your bank account is crucial, especially in today’s fast-paced world. You want to choose a bank that makes it easy for you to access your funds and manage your account effectively.

- Availability of online and mobile banking

- Number of ATMs in your vicinity

- Branch locations for in-person assistance

- Quality of customer service

- Hours of operation for branches and ATMs

A bank that provides convenient access to your funds not only saves you time but also allows you to conduct transactions efficiently, which is important for managing your daily finances.

4. Security Features

In today’s digital age, ensuring the security of your bank account is of utmost importance. Security features can protect your account from unauthorized access and fraud, giving you peace of mind.

- Two-factor authentication for online access

- Fraud detection tools and alerts

- FDIC insurance for deposits

- Encryption protocols on banking transactions

- Regular monitoring of your accounts for suspicious activities

By choosing a bank that prioritizes security features, you protect your assets and ensure a secure banking experience, especially when dealing with large transactions or sensitive information.

5. Additional Services

Beyond just basic banking, many banks offer additional services that can enhance your overall experience. These services vary widely, so it’s important to consider what might be beneficial for your personal or business needs. Examples include savings programs, investment opportunities, and digital financial tools.

When comparing banks, take the time to look at the additional services they offer and how these could potentially benefit you.

- Mobile check deposit

- Personal financial management tools

- Credit card options

- Loan services including mortgages and personal loans

- Investment accounts and advisory services

Having access to additional services can streamline your financial management and provide more value from your banking relationship. Ensuring that your bank can cater to various aspects of your financial life can save you both time and money.

Conclusion

Choosing the right bank account is not merely about the immediate benefits; it’s about aligning your banking choice with your long-term financial goals. By carefully considering account fees, interest rates, accessibility, security features, and additional services, you can set yourself up for a successful banking experience.

Each factor plays a significant role in your day-to-day banking, as well as in your financial strategy moving forward. Making a well-informed decision based on these elements can lead to substantial long-term benefits that enhance your savings and financial security.

Ultimately, the right banking relationship empowers you to achieve your financial goals with ease and confidence. Take the time to research and compare your options to find a bank account that truly meets your needs.