Bank reconciliation is a crucial part of effective financial management for individuals and businesses alike. Keeping your financial records aligned with your bank statements can prevent discrepancies and provide a clear view of your financial health.

In this article, we will explore the importance of bank reconciliation, guide you through the steps to accomplish it, offer helpful tips for success, identify common challenges, and conclude with key takeaways for managing your accounts effectively.

The Importance of Bank Reconciliation

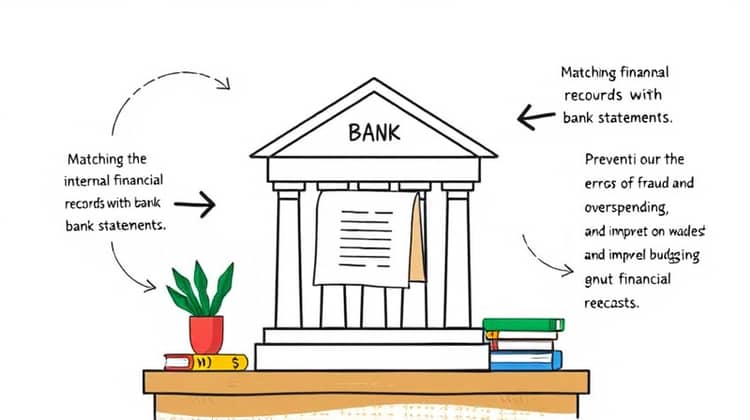

Bank reconciliation allows you to ensure that your internal financial records match your bank statements. This process helps identify any errors in recording transactions on either side, which can prevent potential fraud or overspending.

Regular bank reconciliation ensures that you are aware of your true financial position, enabling better budgeting and financial forecasting. Missing transactions can lead to cash flow problems, and reconciling regularly can help avoid such issues.

Step-by-Step Guide to Bank Reconciliation

The process of bank reconciliation can appear daunting at first, but breaking it down into manageable steps can simplify it significantly. Following a structured approach will help ensure accuracy and efficiency in reconciling your accounts.

Here’s a step-by-step guide to help you navigate through bank reconciliation effectively. If followed diligently, this guide can enhance your financial management and decrease the likelihood of errors.

- Collect your bank statement for the period you wish to reconcile.

- Gather your accounting records or transaction logs that correspond to the same period.

- Compare the transactions on your bank statement with your records, marking off items that match.

- Invest in any discrepancies, noting down unmatched transactions for follow-up. If everything aligns, calculate the balance. Ensure it matches your financial records.

Once you have successfully reconciled your accounts, it is wise to maintain a record of the reconciliation for future reference. This can assist in resolving any future discrepancies more efficiently.

Tips for a Successful Bank Reconciliation

To achieve optimal results during your bank reconciliation, certain best practices can enhance your accuracy and efficiency. These tips will help streamline the reconciliation process, allowing for a more effective review of your financial transactions.

Proactively managing your accounting records, and knowing common pitfalls can make a significant difference.

- Reconcile your accounts regularly, ideally monthly, to catch discrepancies early.

- Use accounting software that automates the reconciliation process, reducing data entry errors.

- Maintain clear documentation for all transactions, making it easier to verify matches during reconciliation.

Implementing these tips can save you time and minimize the effort required in future reconciliations, allowing you to focus on other important aspects of financial management.

Common Challenges and How to Overcome Them

Despite the structured approach to bank reconciliation, there are challenges that can arise. Being aware of these challenges and knowing how to tackle them can save you considerable time and frustration during the reconciliation process.

- Timing differences between your transactions and the bank processing can lead to discrepancies.

- Clerical errors in either your records or the bank statement can complicate reconciliation.

- Lost or missing documents can impede your ability to reconcile accurately.

Being vigilant and organized, as well as leveraging technology, can help mitigate these common challenges and facilitate a smoother reconciliation experience.

Conclusion

In conclusion, bank reconciliation is a vital practice for ensuring your financial records are accurate and up-to-date. Regular and systematic reconciliation can protect you from financial mismanagement and provide clarity on cash flow.

By following the detailed steps provided, you can confidently reconcile your bank accounts and ensure all transactions are accounted for. Additionally, the tips shared aim to enhance your reconciliation process, making it seamless and efficient.

Finally, being cognizant of common challenges can help you navigate any issues that may arise. Preparing for these obstacles can enhance the overall accuracy of your financial management strategy.

In retrospect, investing time in bank reconciliation not only safeguards your assets but also improves your financial planning capabilities for both present and future needs.