When it comes to borrowing money, understanding the terms of the loan is crucial. One such term that borrowers should be aware of is 'balloon payments'. A balloon payment is a type of loan structure where a large final payment is due at the end of the loan term. This can be a shocking revelation for borrowers who might expect to make regular payments throughout the duration of the loan.

Balloon payments can be an attractive option for some borrowers, offering lower monthly payments during the loan term. However, they also come with risks that may not be apparent at first glance. Before opting for a loan with a balloon payment, it's essential to thoroughly understand how it works and the potential implications.

In this article, we will explore the ins and outs of balloon payments, their characteristics, pros and cons, and guide you in deciding whether a balloon payment loan is right for you. We will also look at common types of loans that feature balloon payments and their overall impact on your finances.

Understanding Balloon Payments

A balloon payment loan typically features smaller monthly payments based on a set amortization schedule. Unlike traditional loans, where borrowers make equal monthly payments over the life of the loan, balloon loans have smaller payments that often do not cover the interest, resulting in a substantial payment due at the end of the term.

This final payment is called a 'balloon payment' and can be a daunting amount that catches many borrowers off guard. As such, understanding the mechanism behind balloon payments is crucial for successfully navigating the repayment process.

It is important to note that balloon payments can be found in various types of financing, including mortgages and auto loans. However, the most prominent use of balloon payments tends to be in real estate transactions. These loans typically allow for a short-term borrowing solution, with the expectation that the borrower will refinance or sell the property before the balloon payment comes due.

Characteristics of Balloon Payments

Balloon payments offer unique characteristics compared to traditional loan structures that require full amortization throughout the term. Understanding these characteristics is essential for borrowers considering this type of financing.

One key feature is the lower monthly payments during the loan term, which can provide immediate cash flow relief. However, borrowers need to remain vigilant about the looming balloon payment, which is a significant financial obligation that must be planned for.

- Lower monthly payments during the loan period.

- Large final payment due at the end of the term.

- Potential for financial strain if not prepared for the balloon payment.

Because of these characteristics, borrowers often find balloon payments attractive for short-term financial relief, but they must ensure they have a plan in place for the final large payment to avoid financial strain.

Common Types of Loans with Balloon Payments

Balloon payments are commonly associated with specific types of loans, particularly those intended for short-term financing needs. Some common types of loans that might include balloon payment structures are.

- Mortgage loans (especially those for investment properties).

- Auto loans or leases that allow for a large final payment.

- Commercial loans for businesses looking for cash flow relief.

Each of these loans comes with its unique stipulations regarding the balloon payment, and borrowers should fully understand all terms before committing to one of these arrangements.

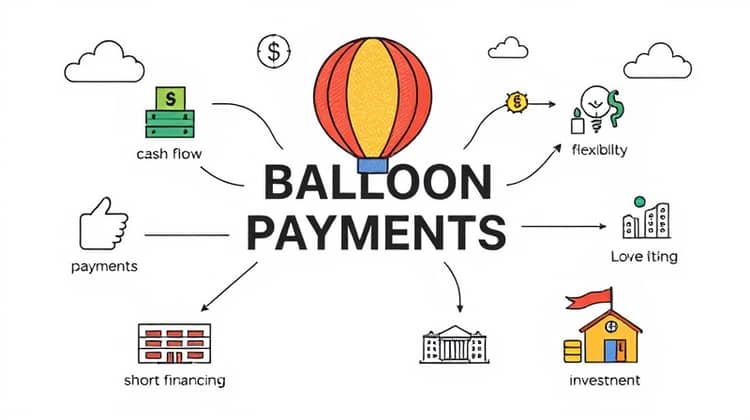

Pros of Balloon Payments

There are several advantages that make balloon payments appealing to certain borrowers. The primary benefits center around cash flow and flexibility, which can be significant for individuals or businesses in transition.

Because these loans feature lower monthly payments, borrowers can allocate their resources to other priorities. This makes balloon payment loans particularly useful for short-term financing, allowing borrowers to cover immediate costs while planning for long-term solutions.

- Lower upfront costs due to reduced monthly payments.

- Flexibility in terms of managing short-term cash flow needs.

- Opportunity to invest saved cash into other ventures during the loan term.

These benefits can make balloon payments an attractive option, particularly for borrowers who are confident in their ability to manage the eventual final payment.

Cons of Balloon Payments

Despite their advantages, balloon payments carry notable risks that every borrower should be aware of before proceeding. For one, the looming large payment can create significant financial pressure for borrowers who underestimate their financial obligations when the time comes.

If borrowers do not have a clear plan to tackle the balloon payment or if their financial situation changes unexpectedly, they may face severe consequences, including the risk of default.

- Potential for financial strain if unable to pay the balloon payment.

- Increased costs if borrowers need to refinance due to inability to pay.

- Risk of losing the financed asset if default occurs.

These disadvantages highlight the importance of careful consideration and planning before entering into a balloon payment agreement.

Whether or Not to Go for It?

Before committing to a balloon payment loan, prospective borrowers should conduct thorough research and consider their current and future financial situations. Key factors to evaluate include income stability, other financial commitments, and personal financial goals.

Borrowers should also consult with financial advisors or mortgage brokers who can provide additional insights into the viability of a balloon payment structure based on individual circumstances. Being well-informed is crucial to navigating the uncertainties associated with such financial commitments.

Ultimately, choosing whether to accept a balloon payment loan should require careful evaluation of both the benefits and risks, ensuring that borrowers have strategies in place for addressing their final payment obligations.

Manufacture Balloon Payments

Understanding the factors that influence the creation of balloon payments can be crucial for borrowers and lenders alike. Lenders often use balloon payments as a way to mitigate risk while also offering competitive loan terms that attract borrowers.

Borrowers should be aware that different lenders may have varying policies around balloon payments, including the size of the balloon payment, interest rates, and amortization schedules. This highlights the importance of shopping around and comparing various loan products before making a final decision. Lenders may create these terms based on their assessment of market conditions and borrower risk profiles, which can significantly impact the loan's cost and structure.

Conclusion

In conclusion, balloon payments are an innovative yet potentially risky financial solution that allows borrowers to take on loans with lower monthly payments. However, they also present significant challenges due to the large final payment that's due at the end of the loan term. Familiarizing yourself with the characteristics, pros and cons, and common types of loans that may include balloon payments can aid in making informed financial decisions. Always consider your financial situation and consult with professionals before proceeding with such arrangements.