Managing your finances can often feel overwhelming, but it doesn't have to be, especially when it comes to bank fees. Many individuals unknowingly pay these fees, which can quickly add up and hurt their budgets. By understanding what these fees are and how to avoid them, you can save a significant amount of money each year.

In this article, we’ll explore seven simple strategies that can help you sidestep annoying bank fees so you can keep more of your hard-earned money. From choosing the right type of account to maintaining your balance, these tips are straightforward and effective.

Whether you're a seasoned banker or just starting your financial journey, practicing these habits will put you on the path to financial success.

Understanding Bank Fees

Bank fees can be a hidden drain on your finances. Many people are unaware of how much they are spending on fees related to their checking and savings accounts. These fees can include account maintenance fees, overdraft fees, and ATM withdrawal fees, among others.

It's important to take a closer look at these fees because they can seriously impact your savings and especially your financial health over time. Many banks charge these fees without providing significant benefits in return, which makes it critical to know what you're paying for.

Understanding the types of bank fees can empower you to make better financial decisions and to choose a bank that aligns with your needs.

- Monthly account maintenance fees

- ATM withdrawal fees

- Overdraft fees

- Foreign transaction fees

- Minimum balance fees

Being aware of these fees is the first step towards avoiding them. Many banks offer free checking and savings accounts that do not charge these types of fees if certain conditions are met. Therefore, it is beneficial to explore your options carefully before deciding where to bank.

By adopting proactive strategies and being vigilant about bank charges, you can reduce your financial burdens significantly.

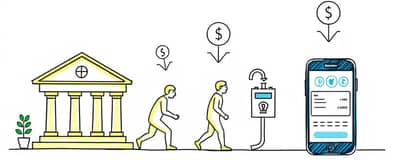

1. Opt for Free Checking Accounts

One of the simplest ways to avoid bank fees is to choose a checking account that comes with no monthly maintenance fee. Many banks and credit unions offer free checking options to attract new customers. It's wise to shop around and find the right institution for your needs.

In addition to monthly fees, look for accounts that waive fees for services like ATM withdrawals or international transactions. Understanding the terms and conditions is crucial when selecting a bank that fits your lifestyle.

Many banks now operate online and are able to offer free accounts because they have lower overhead costs. These accounts can save you money and provide the same services as traditional banks.

- No monthly maintenance fee

- No overdraft fees with set conditions

- No minimum balance requirement

Choosing a free checking account is about knowing what options are available and making an informed choice. This decision can keep more money in your pockets and help you better manage your finances.

2. Maintain Minimum Balance

Another effective strategy to avoid unnecessary fees is by maintaining a minimum balance in your bank account. This practice can enable you to sidestep fees that banks impose for accounts that dip below a certain threshold.

Often, banks will require you to maintain a minimum balance in order to enjoy benefits like waiving monthly fees or receiving higher interest rates on savings. Understanding these requirements can help you keep your account in good standing without incurring extra costs.

Monitoring your balance is key. Regularly checking your account and planning your expenses can assist you in maintaining the required minimum.

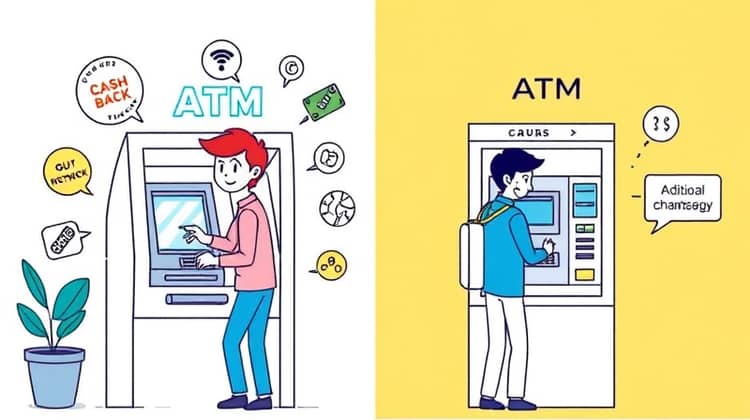

3. Use In-Network ATMs

Using ATMs that are part of your bank’s network can significantly help reduce withdrawal fees. When you use an ATM outside your bank's network, you may incur additional charges from both your bank and the ATM operator.

Many banks also offer cashback or other incentives for using their ATMs, which can enhance your banking experience while avoiding unnecessary charges and fees.

- Locate your bank's ATM network

- Avoid surcharge fees from out-of-network ATMs

- Take advantage of cashback offers at point-of-sale transactions

Always plan your cash withdrawals to avoid the inconvenience of out-of-network fees. By sticking to ATMs within your bank's network, you’ll save money and ensure easier access to your funds.

4. Set Up Direct Deposit

Setting up direct deposit for your paycheck is another fantastic way to avoid bank fees. Many banks waive monthly fees if you have a steady income deposited directly into your account. This service is often quick and easy to establish with your employer or any income source.

Having your funds deposited directly into your account not only helps you avoid fees but also makes managing your finances more efficient as your money becomes accessible immediately.

5. Avoid Overdraft Fees

Overdraft fees can be some of the most expensive charges a bank can impose. They occur when you spend more money than what is available in your account. To avoid these costly fees, make it a habit to regularly monitor your account balance.

If you are prone to overdraft, consider setting up low-balance alerts from your bank to receive notifications when your funds are running low.

- Keep track of your account balance regularly

- Set up alerts for low balances

- Consider overdraft protection options

Being proactive about your spending habits can help keep you out of the overdraft zone. Working towards solving the issue and establishing a budget will not only prevent fees but will also improve your financial health.

6. Be Cautious with Transfers

Bank transfers can sometimes incur fees, particularly if you’re sending money internationally or transferring out of your bank’s network. It’s important to understand the fee structures associated with various types of transfers before proceeding.

Before making a transfer, always double-check whether there are any fees, especially with wire transfers or currency exchanges.

- Avoid international wire transfers when possible

- Use services like peer-to-peer apps for small amounts

- Choose currency exchange services wisely

Being cautious with transfers is essential to keeping your bank fees in check. Moreover, using cost-effective methods for transferring money can drastically improve your financial management.

7. Pay Attention to Account Changes

Regularly reviewing your bank account statement is vital; sometimes fees can change without warning. Banks periodically update their policies and fee structures, which means what was once free could become costly.

Staying informed about changes in your bank can save you from unexpected fees. Always read the terms and any notifications from your bank regarding changes in fees or services offered.

The Bottom Line

Being knowledgeable about bank fees can empower you to effectively manage your finances. By implementing small but impactful strategies, you can avoid unnecessary costs and save money in the long run.

Choosing the right banking options and habits is instrumental in protecting your finances. Step-by-step, making informed decisions can lead to significant savings and improved financial health.