In today's fast-paced world, managing personal finances can feel like a daunting task, especially with multiple bills due on different dates. Automatic bill payments offer a solution that simplifies this process, allowing individuals to streamline their financial obligations. By empowering customers to automate their payments, service providers are making it easier for people to manage their finances and avoid late fees.

Setting up automatic bill payments not only saves time but also reduces the stress associated with tracking and remembering various due dates. This system ensures that payments are made promptly, providing peace of mind and a sense of financial control. With increasing reliance on technology, more people are embracing this trend to optimize their billing processes.

In this article, we will explore the steps involved in setting up automatic bill payments, the benefits of using this service, and how to manage any potential risks or challenges associated with it. Whether you're a tech-savvy individual or just starting to delve into personal finance management, this guide aims to provide helpful insights to simplify your journey.

Why Automatic Bill Payments?

Automatic bill payments offer relevancy in today's digital age, especially as more people juggle various financial obligations. This method allows you to pay your bills electronically on a set schedule, removing the hassle of mailing checks or processing payments manually. It streamlines the entire process, making financial management much simpler.

One of the main reasons behind the growing popularity of automatic bill payments is the convenience they provide. With just a few clicks on your computer or smartphone, you can ensure that all of your bills are paid on time. This eliminates the need for physical paperwork and significantly reduces the chances of forgetting a payment, which can lead to late fees and service interruptions.

Additionally, automatic bill payments can help individuals improve their financial discipline. By automating payments, you are forced to check your bank balance regularly and plan your finances accordingly. This practice encourages you to keep track of your spending and makes it easier to allocate funds effectively.

Getting Started with Automatic Bill Payments

To get started with automatic bill payments, it is essential to identify which bills you want to automate. Common candidates include utilities, credit card payments, insurance premiums, and subscriptions. By making a list of these expenses, you can determine which ones fit well into a systematic payment schedule.

Once you've compiled your list, the next step is to set a payment schedule. Consider aligning due dates to align with your income cycle for better cash flow management. This way, payments will be made when you have sufficient funds in your account, avoiding overdrafts. Ultimately, finding the right balance will help maintain your financial stability.

- Determine the bills you want to automate.

- Review your bank account for sufficient funds.

- Check the due dates of the bills.

- Set a payment schedule that aligns with your paydays.

Once you have established this schedule, you can begin setting up automatic payments through your bank or service providers. Each service provider typically has its own procedure for setting up these payments, which can vary in complexity. Therefore, it's essential to follow their instructions carefully to ensure a seamless setup.

With automatic bill payments in place, you can enjoy a stress-free financial life, but it’s important to periodically review your accounts and bills to adjust your budget as needed.

Benefits of Automatic Bill Payments

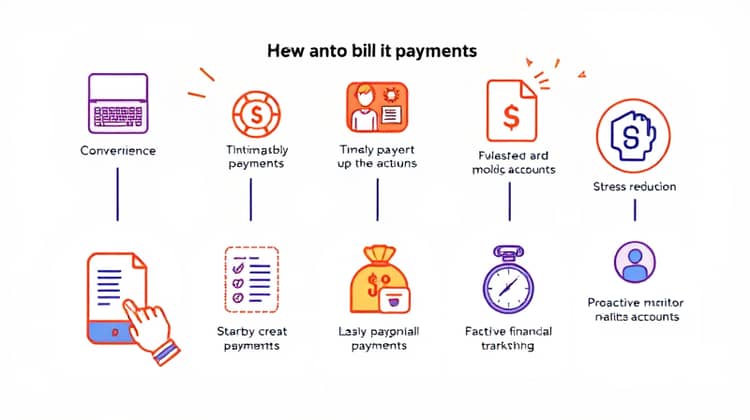

Automatic bill payments come with a variety of benefits, making them an attractive option for many individuals. One of the most significant advantages is the prevention of late payments. When you automate your bills, you minimize the risk of forgetting to make payments, thus avoiding late fees and possible service disruptions.

In addition to fee avoidance, automating your payments also enhances your personal finance management. With consistent monthly payments being deducted automatically, you can create more accurate budgets and track your spending habits effectively. This insight helps you ascertain where you might be able to cut expenses or save more money in the long term.

- Convenience of managing multiple bills at once.

- Consistency in financial tracking and budgeting.

- Reduction of late fees and penalties.

- Improved credit score through timely payments.

Overall, automatic bill payments can transform your bill management process from a cumbersome task into a straightforward monthly routine. With the ability to automate most of your bills, your financial life becomes a lot easier, allowing you to focus on other important aspects of your time and energy.

This approach not only saves time but also helps cultivate positive financial habits that can contribute to long-term financial health.

How to Set Up Automatic Bill Payments

Setting up automatic bill payments involves several straightforward steps. These actions ensure that you have everything in place before committing to automated payments, allowing for a smooth transition into this system. Your first step is to determine which bills you want to automate, since not all bills may require this service.

Understanding your specific needs will help you to avoid complications in your financial processes and maintain full control over which payments are automated.

1. Choose the Bills to Automate

The first step in setting up automatic bill payments is to identify which bills you will automate. Start by listing all your recurring expenses, such as utility bills, rent or mortgage payments, gym memberships, and insurance premiums. By organizing these expenses, you can easily determine which bills are suitable for automation.

Once you have identified all your bills, prioritize them based on due dates and amounts. It's prudent to start with high-priority bills that can cause significant issues if paid late. For example, payments for housing and utilities should take precedence over subscription memberships or elective services.

Assessing the regularity and predictability of your bills will also guide you in selecting which ones should be automated. Ensure that these expenses are consistent every month, as fluctuating bills can complicate automatic payments and may result in overdrafts or late fees if not managed properly.

2. Contact Your Service Providers

After selecting the bills you'd like to automate, the next step is to contact each service provider. Many service providers offer the option for customers to set up automatic payments through their official websites or customer service lines. Reach out to them via the channel of your choice to learn about their specific processes and requirements.

While contacting your service providers, verify their payment options. Some may allow you to set up payments through your bank, credit card, or third-party payment applications. Additionally, make sure you ask about their policies on processing fees, payment failures, or cancellations so you can effectively manage your financial commitments.

Ensure to provide the necessary information they require, such as account numbers, payment amounts, and the frequency of payments. This step is crucial to initiate the automation correctly.”]},

section_4_3

3. Set up Payments through Your Bank

Next, you can set up automatic payments through your bank, which offers a centralized management system for your recurring expenses. Log in to your online banking account and navigate to the bill payment section. Choose to add a new bill and input the details of the service providers you automated.

Your bank will typically require you to enter your account number, payment amount, and payment frequency. Depending on your bank, it may also allow you to set reminders for when bills are due, helping to ensure you manage any necessary changes to your budget in advance.”

Review your settings to ensure that you have entered the correct information before saving your settings. Confirm that the bank will not charge you for these services, as some financial institutions may impose fees for automatic payments.

4. Use Online Payment Services

An alternative method for setting up automatic bill payments involves online payment services. These platforms often provide an easy-to-use interface for connecting all your bills in one place, making it convenient for you to manage your payments online. You can use platforms like PayPal, Venmo, or other financial apps to set up recurring payments for specific services.

When employing online payment services, be sure to check their fee structures and customer service policies. This research can help you avoid unpleasant surprises later on and ensure that you'll get efficient service in case you experience any issues with your payments.

Tips for Maintaining Automatic Payments

While automatic payments can simplify your financial life significantly, it is still essential to monitor them closely. Regularly check your bank accounts for successful payments and to ensure that you have adequate funds to cover these expenses. This vigilance will help mitigate potential overdrafts and ensure that your financial commitments are met.

Another important tip is to review your bills frequently and track any changes in fees or due dates. Automated payments should not be a "set it and forget it" process, as unexpected increases in charges may occur, affecting your budgeting. Keeping alert and informed will enable you to adjust your payment settings when necessary.

Finally, align your automated payments with your income cycle to ensure that there's always enough money in your account to cover these expenses, which minimizes the risk of missed payments. Regularly updating your budget will also help you manage any unexpected financial situations effectively.

- Set calendar reminders to review your payments regularly.

- Maintain emergency savings to cover unexpected expenses.

- Notify service providers of any changes in your payment information.

By adhering to these tips, you can create a healthy system for managing your automatic bill payments and mitigate potential financial pitfalls.

Managing Risks and Challenges

As beneficial as automatic bill payments are, awareness of the risks and challenges is crucial. These payment systems, if not monitored properly, can lead to unintentional overspending, canceled services, or even identity theft if sensitive information is compromised. Hence, continuous monitoring is an essential practice while using automated payments.

Common Challenges

One common challenge involves the lack of attention paid to automated payments. Customers may forget about these transactions until they receive their bank statements or realize money is missing from their accounts. This oversight can lead to confusion and unexpected consequences when trying to adjust a budget.

Additionally, fluctuating bills, such as utilities or credit cards, can result in overspending if not monitored. Without regular review, you may inadvertently spend more than intended, which could impact your financial goals negatively.

- Neglecting to monitor automated payments.

- Forgetting about varying bill amounts and due dates.

- Falling victim to identity theft.

Configuration errors are another potential risk factor when setting up automatic payments. Be vigilant and ensure correct input of all billing details to safeguard against potential payment failures or disputes.

Risk Management

Risk management is critical when dealing with automatic bill payments. Taking the time to review your financial processes can help identify areas where mistakes can happen or expenses mismanaged. Start by periodically checking your bank statements for accuracy and review the scheduled payments to ensure they fit your budget.

In addition, be cautious of any unauthorized charges by regularly monitoring your accounts. Having safeguards in place, like alerts from your bank for unusual activities, can significantly reduce the risk of falling victim to fraud.

- Set up alerts for unusual transaction activities.

- Regularly review bank statements to identify errors.

- Maintain updated records of all automated payments.

These strategies can make navigating automatic bill payments considerably safer and allow you the peace of mind knowing your finances are being managed effectively.

Conclusion

In conclusion, automatic bill payments can transform how you manage your finances while providing convenience and promoting timely payments. By taking advantage of this technology, you save time, reduce stress, and establish better financial habits. Nevertheless, it's essential to remain vigilant and proactive about monitoring your accounts to maximize the benefits of this system.

As you embark on setting up automatic bill payments, remember to choose your bills wisely, stay informed about changes in your expenses, and maintain a budget that accommodates your payment schedules.